Ranking Tech M&A Latin America

Deals and investments november 2025

Overview of M&A market in LatAm

Latin America recorded 2,656 M&A transactions between January and November 2025, totaling USD 95.9B, according to TTR Data and Datasite. Despite a 3% drop in deal volume, total value increased 13%, reinforcing the region’s shift toward fewer but larger and more strategic transactions driven by technology, financial services, and cross-border consolidation.

M&A Tech LatAm overview – Nov ’25

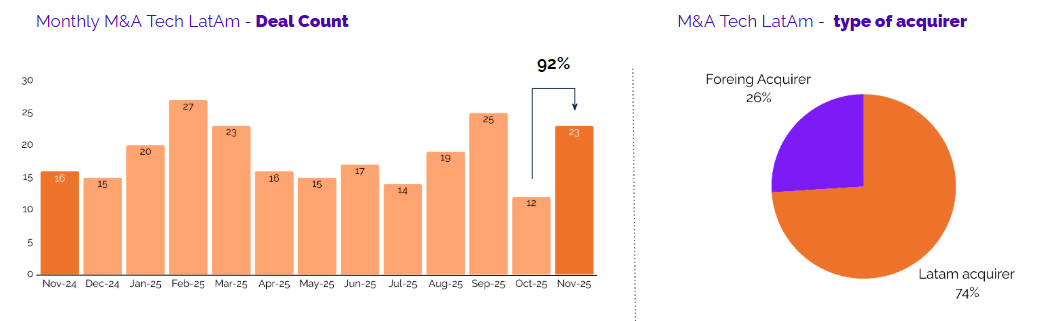

Tech M&A activity in Latin America rebounded in November 2025, reaching 23 transactions—nearly double October’s low of 12 and matching March’s elevated levels. The uptick marks a strong recovery after one of the quietest months of the year, suggesting that buyers accelerated decision-making as year-end approached.

Trends by country

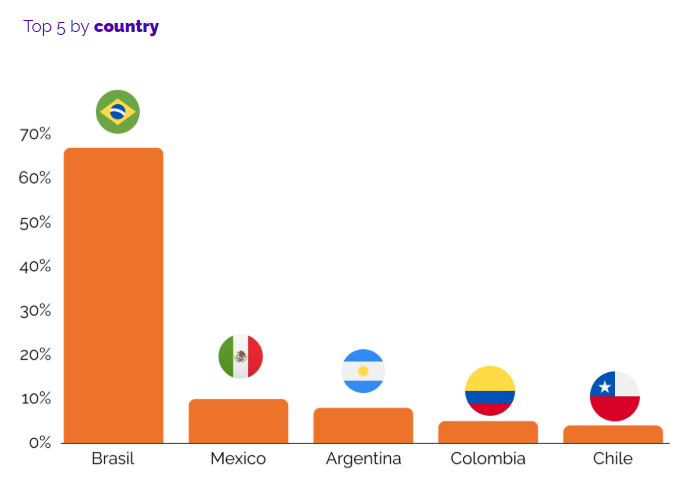

Brazil remained the dominant market in November 2025, accounting for 66.7% of all tech M&A transactions in Latin America. Mexico followed with 10.3%, while Argentina reached 7.7%, Colombia 5.1%, and Chile 3.8%, with Uruguay and Other markets each capturing small shares of activity. The distribution reinforces Brazil’s outsized role, with secondary markets contributing steady but comparatively modest deal flow.

Trends by vertical industry

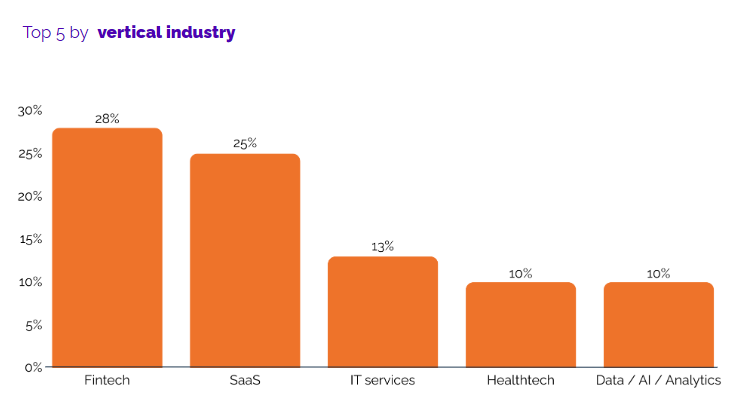

Fintech led tech M&A activity in November 2025, accounting for 28.2% of all transactions. SaaS followed with 25.6%, while IT Services captured 12.8%. Healthtech and Data/AI/Analytics each represented 10.3%, reflecting a month dominated by financial infrastructure, enterprise software and AI-driven capabilities.

Explore the full report below for deeper insights and a breakdown of tech deals and investments by country and sector.

Subscribe to our Newsletter

Subscribe to receive the most important M&A updates for the tech sector in LatAm every month.