Ranking Tech M&A Latin America

Deals and investments july 2025

Overview of M&A market in LatAm

Latin America’s M&A market recorded 1,591 transactions in the first seven months of 2025, with a total deal value of US $58.8 billion. This reflects a 6% decline in deal volume compared to the same period in 2024, accompanied by a notable 24% increase in total value—highlighting a trend toward fewer but larger and more strategic deals. – In July alone, the region saw 181 transactions worth US $10.55 billion, pointing to a particularly active month.

M&A Tech LatAm overview

July 2025 recorded 14 tech M&A transactions in Latin America—down from June (17) and May (15), and well below the February peak (27). The slowdown suggests a softer start to Q3 after a relatively stable Q2.Trend insight: Tech M&A volume in H1 2025 reached 118 transactions—up 30% from the 91 recorded in H1 2024, signaling a solid recovery in the region’s dealmaking momentum.

LatAm buyers accounted for 43% of tech M&A transactions in July 2025. Foreign acquirers regained majority control at 57%, reflecting renewed cross-border appetite.

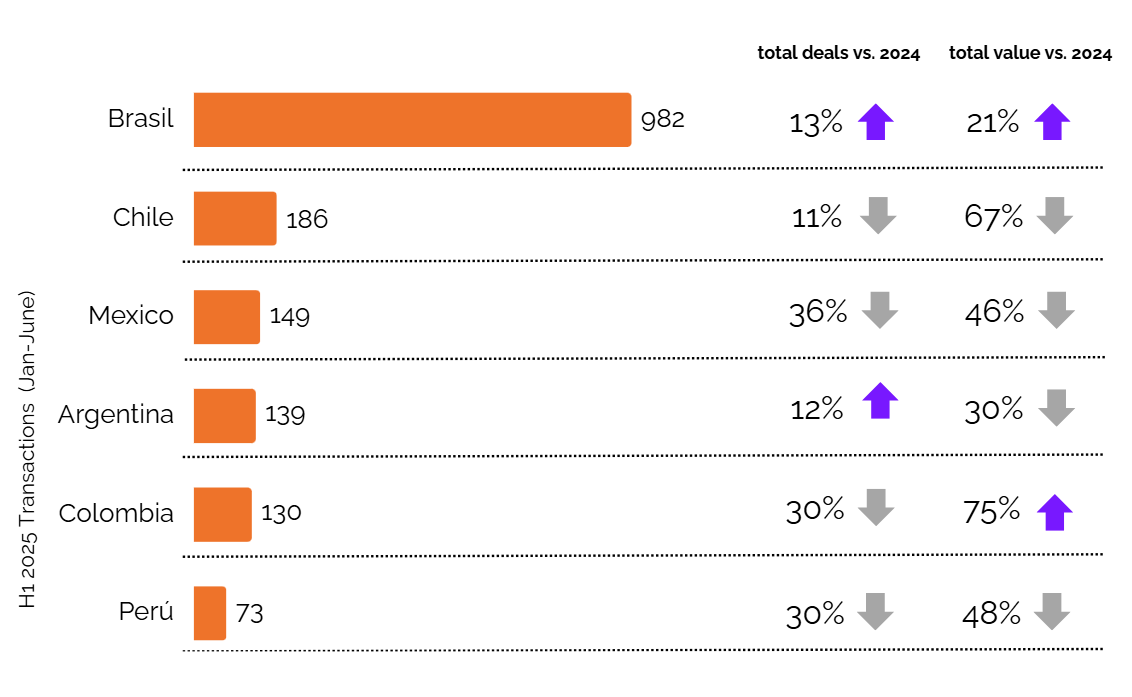

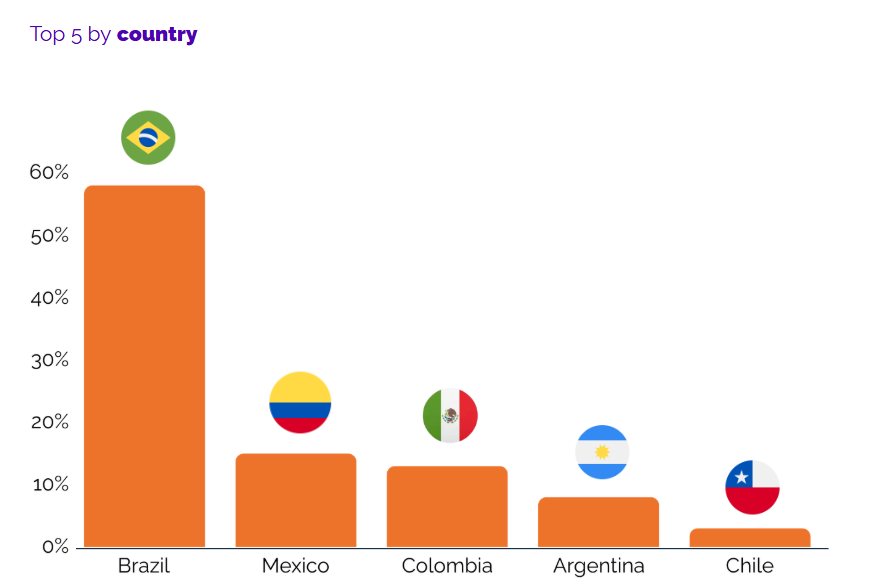

Trends by country

Brazil remained the regional leader in tech M&A activity in July 2025, accounting for 58% of all transactions—continuing its dominance despite a gradual decline from earlier in the year. Mexico ranked second with 15%, followed closely by Colombia with 13%, while Argentina captured 8% and Chile 3%.

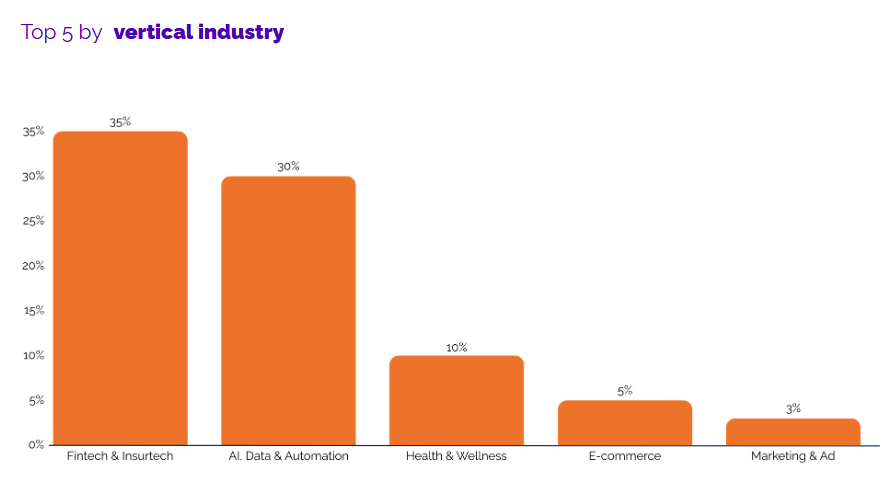

Trends by vertical industry

Fintech and insurtech led tech M&A activity in July 2025, representing 35% of all transactions. AI, data, and IT services followed closely with 30%, while health & wellness accounted for 10%. Retail & e-commerce captured 5%, and marketing & advertising together with sportstech each held 2.5%.

Deals and investments:

Some of the standout moves shaping current trends:

M&A:

- Confience–Labsoft Tecnologia (LatAm),

- Visma Latam–Talana (Chile/Perú)

- tapi –Arcus, a Mastercard company (México),

- FiT –Neurona Tecnología Financiera (Colombia),

- BigID–illow (Argentina).

Investments:

- Klar (México, US$190M)

- Plata Card (México, US$120M)

- Addi (Colombia, US$35M)

- Avista Colombia (Colombia, US$10M)

- Unblock (Argentina, US$13.5M)

Explore the full report below for deeper insights and a breakdown of tech deals and investments by country and sector.

Subscribe to our Newsletter

Subscribe to receive the most important M&A updates for the tech sector in LatAm every month.