Tech M&A Q2 report 2025

Deals and investments

Overview

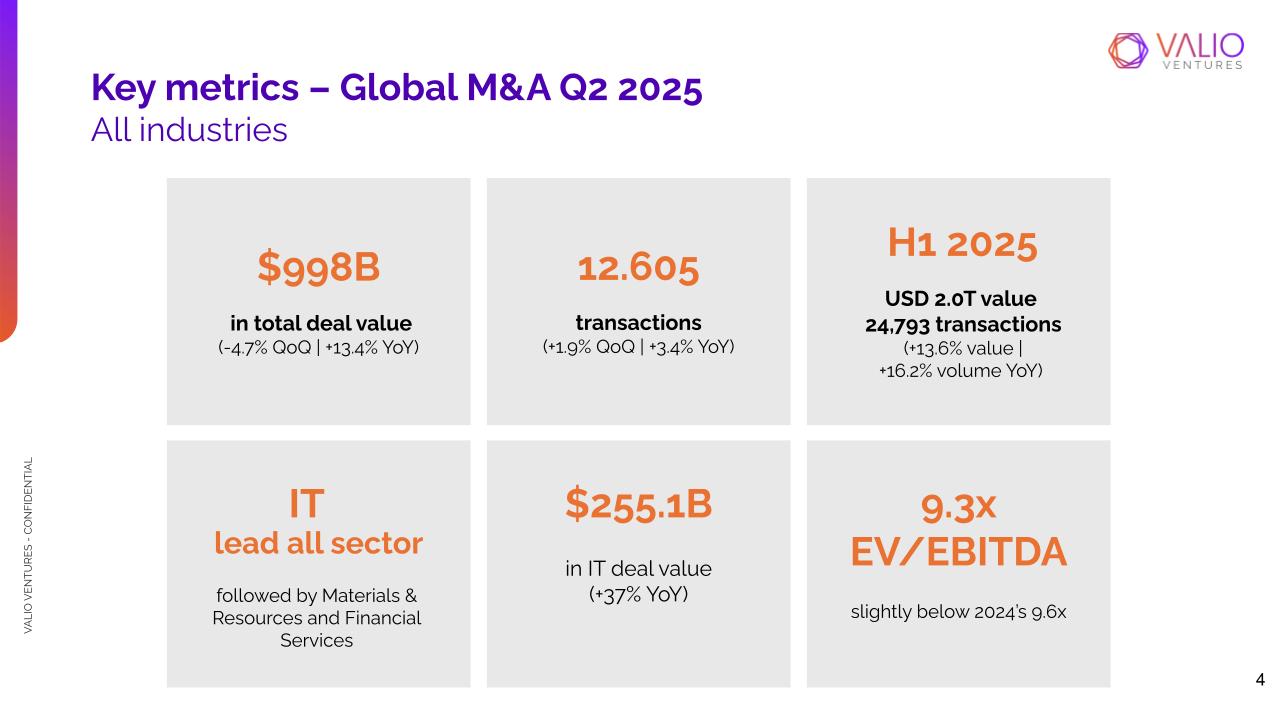

Q2 2025 confirmed the resilience of global tech M&A, with dealmakers doubling down on high-quality, high-impact transactions despite a complex macro backdrop. The quarter saw stable volumes, rising premiums, and a clear sector rotation toward IT, driven by AI, cybersecurity, and cloud infrastructure.

In Latin America, activity shifted toward fewer but larger transactions, with technology accounting for two-thirds of total M&A value. Brazil maintained its lead, while Argentina posted sustained double-digit growth in both deal count and value, underscoring the region’s role as a strategic growth hub in the global dealmaking landscape.

Global Tech M&A Activity

Global tech M&A maintained strong momentum in Q2 2025, recording 1,995 deals—a 12% YoY increase—while total deal value surged to $255.1 billion, up 37% from the same quarter last year. IT led all sectors, driven by large-scale consolidation in network infrastructure and continued appetite for AI-enabled platforms.

Mega-deals remained a key driver, with several landmark transactions reshaping strategic positions in cloud, data management, and AI hardware. Strategic buyers dominated, while private equity activity was selective but notable in category-leading assets.

Key trends:

- Deal value growth of 19.9% QoQ and 37.1% YoY, led by IT sector consolidation

- Mega-deals anchored by transactions in AI, data integration, and communications infrastructure

- Strategic acquirers accounted for the majority of deals, reflecting focus on scale and defensibility

- Valuation multiples remained solid: 9.3x EV/EBITDA and 1.5x EV/Revenue for global M&A overall, with tech commanding a premium

LatAm M&A Overview:

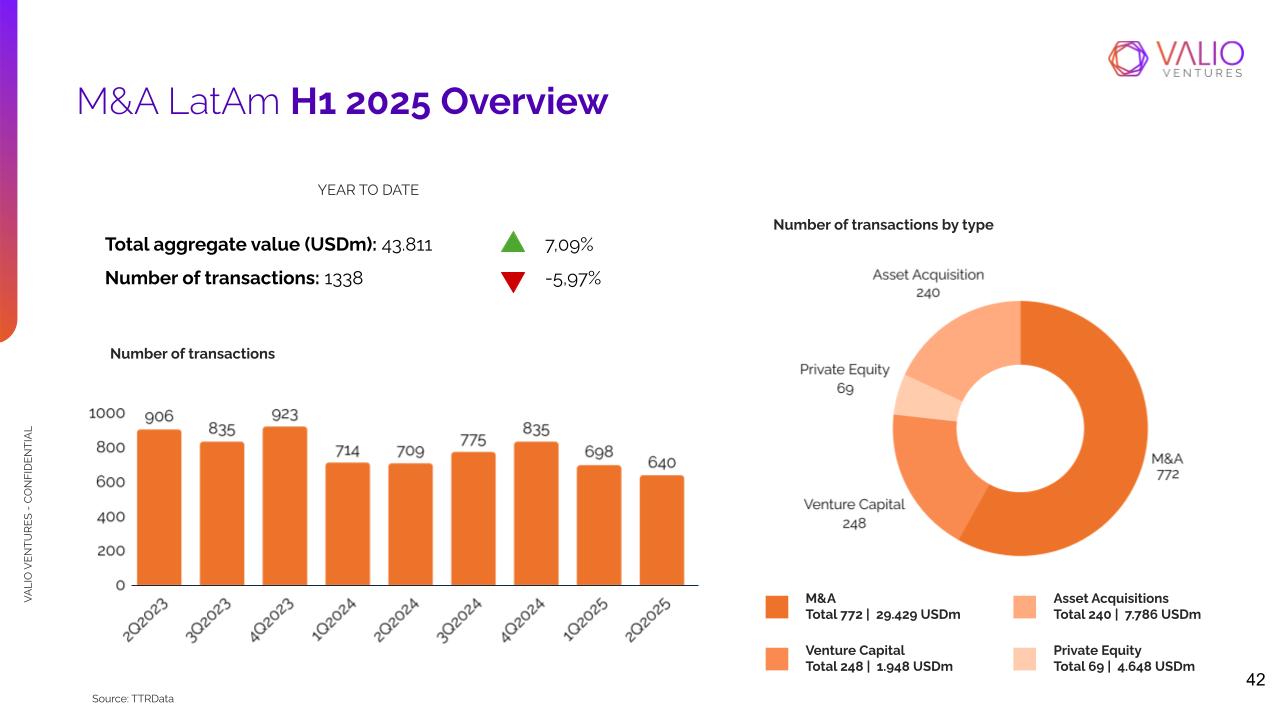

Latin America recorded a total of 1,338 M&A transactions during the first half of 2025, totaling USD 43.8 billion. While deal volume fell by 6% compared to H1 2024, the aggregate value rose 7%—reflecting a market increasingly driven by larger and more strategic transactions.

Brazil remained the regional leader with 827 deals and USD 25.6 billion in value, showing modest growth in volume (+1%) but a solid 12% increase in capital mobilized. Argentina continued to defy regional trends, with 114 transactions (+14%) and a 62% surge in deal value (USD 3.49B), consolidating its position among the top three markets in Latin America.

Colombia saw a drop in volume but grew 14% in value (USD 3.5B). In contrast, Mexico (‑23% in value), Chile, and Peru posted notable declines, reflecting a more cautious investment climate.

Wrapping Up:

Q2 2025 reinforced a market dynamic of “fewer but bigger” deals—where discipline and selectivity coexist with bold, high-value bets. While overall volumes softened, mega-deals in AI, infrastructure, and software underscored buyer conviction in transformative assets.

In Latin America, activity concentrated around technology, with Brazil and Mexico driving deal flow and Argentina extending its streak of sustained growth through H1. The region continues to attract both regional consolidators and global players, particularly in SaaS, fintech, and AI-enabled platforms.

Looking ahead, with valuations stabilizing and capital deployment becoming more targeted, M&A remains the most relevant pathway to scale, liquidity, and digital transformation. The second half of 2025 will likely be defined by continued strategic consolidation and an even sharper focus on category leaders.

Subscribe to our Newsletter

Subscribe to receive the most important M&A updates for the tech sector in LatAm every month.