Ranking Tech M&A Latin America

Deals and investments june 2025

Overview of M&A market in LatAm H1 2025

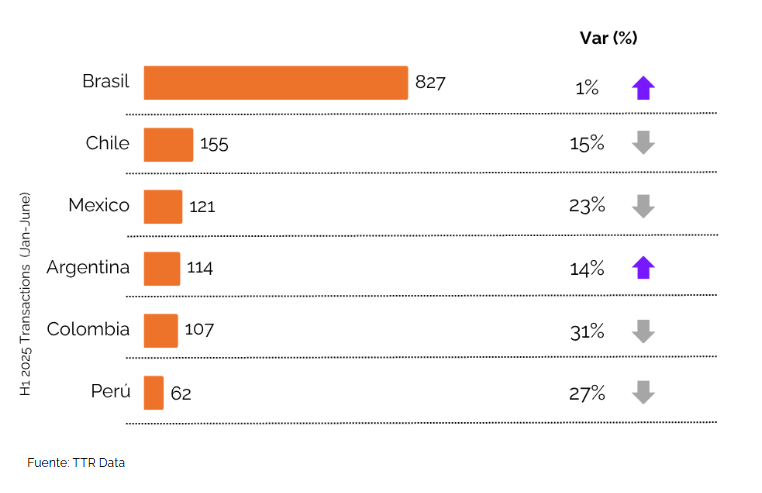

Latin America recorded a total of 1,338 M&A transactions during the first half of 2025, totaling USD 43.8 billion. While deal volume fell by 6% compared to H1 2024, the aggregate value rose 7%—reflecting a market increasingly driven by larger and more strategic transactions.

Brazil remained the regional leader with 827 deals and USD 25.6 billion in value, showing modest growth in volume (+1%) but a solid 12% increase in capital mobilized. Argentina continued to defy regional trends, with 114 transactions (+14%) and a 62% surge in deal value (USD 3.49B), consolidating its position among the top three markets in Latin America.

M&A Tech LatAm overview

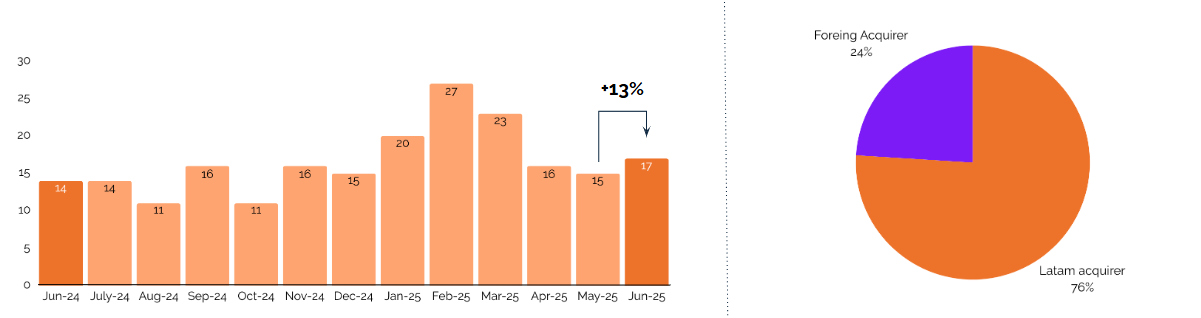

June 2025 recorded 17 tech M&A transactions in Latin America—an uptick from May (15) and slightly above the April figure (16). While still below the February peak (27), June’s rebound suggests a potential stabilization after the Q2 slowdown.

Trend insight: Tech M&A volume in H1 2025 reached 118 transactions—up 30% from the 91 recorded in H1 2024, signaling a solid recovery in the region’s dealmaking momentum.

Trends by country

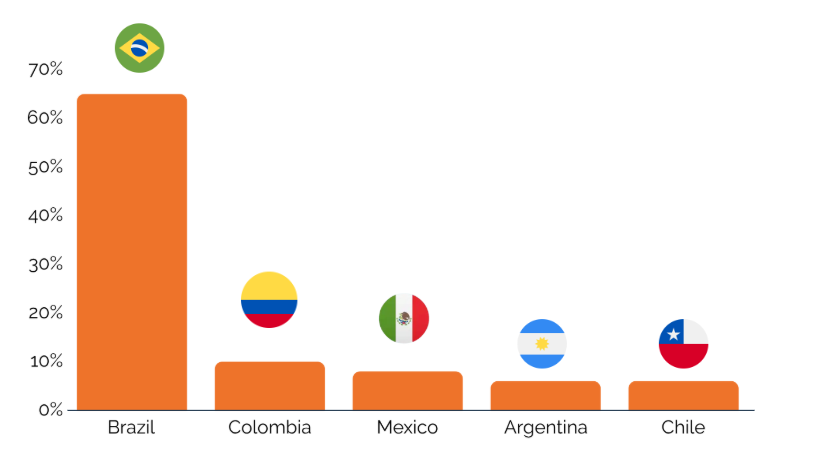

Brazil remained the regional leader in tech M&A activity in June 2025, accounting for 65% of all transactions—recovering ground after a brief dip in May. Colombia ranked second with 10%, followed by Mexico (8%), Chile (6%), and Argentina (6%).

Trends by vertical industry

Fintech and insurtech led tech M&A activity in June 2025, representing 45% of all transactions—well ahead of other sectors. AI, data, and Automation followed with 16%, while health & wellness accounted for 12%. Marketing & ad and e-commerce rounded out the top five, each with 6%.

Trend insight: The dominance of fintech and insurtech reflects continued investor appetite for financial infrastructure across Latin America. Meanwhile, the growing presence of AI-driven and health-related solutions signals rising interest in scalable, high-impact verticals beyond traditional tech segments

Deals and investments:

Some of the standout moves shaping current trends:

-

Siigo (🇨🇴) acquired KAME ERP (🇨🇱), expanding its regional footprint in cloud-based ERP solutions.

- – Reliv added Hospisoft to strengthen its digital health stack.

- – Tiendanube / Nuvemshop acquired VICI, doubling down on product discovery and shopping experience.

- – Revolut entered 🇦🇷 with the acquisition of Banco Cetelem.

- – INT3GRITY integrated Álaga, expanding its digital credit ecosystem for SMEs.

- – dLocal (🇺🇾) announced the acquisition of AZA Finance, extending its payments network into Africa.

Explore the full report below for deeper insights and a breakdown of tech deals and investments by country and sector.

Subscribe to our Newsletter

Subscribe to receive the most important M&A updates for the tech sector in LatAm every month.