2025 Tech M&A Full Year Report

Deals and investments

Tech M&A 2025: Scale returns, but selectivity defines the market

2025 marked a clear inflection point in global M&A activity.

Global deal value approached $5 trillion, with momentum accelerating significantly in the second half of the year. But the rebound was not broad-based. It was driven by large, transformational transactions.

Megadeals once again became the primary engine of value creation — reshaping the structure of the market and reinforcing a scale-driven dynamic.

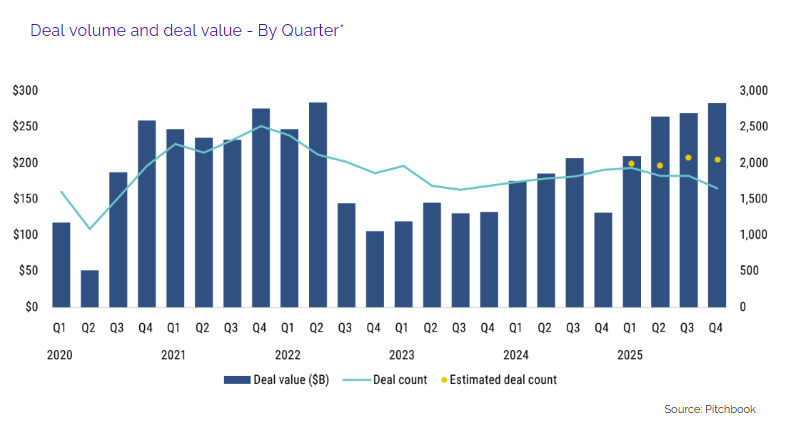

IT M&A approaches the $1 Trillion milestone

Technology M&A reflected the same pattern — but amplified.

IT deal value reached nearly $990 billion in 2025, approaching the $1 trillion mark. Value growth outpaced transaction volume, signaling a market focused on strategic, high-impact acquisitions rather than volume expansion.

AI and digital infrastructure were central to this cycle. Large transactions increasingly referenced AI integration, automation and infrastructure buildout as core drivers of strategic consolidation.

At the same time, valuation dynamics reveal a more disciplined market. Private transaction multiples continue to trade at meaningful discounts versus public markets, and premiums are increasingly concentrated in companies demonstrating EBITDA margins above 20%, reinforcing the shift toward quality-driven dealmaking.

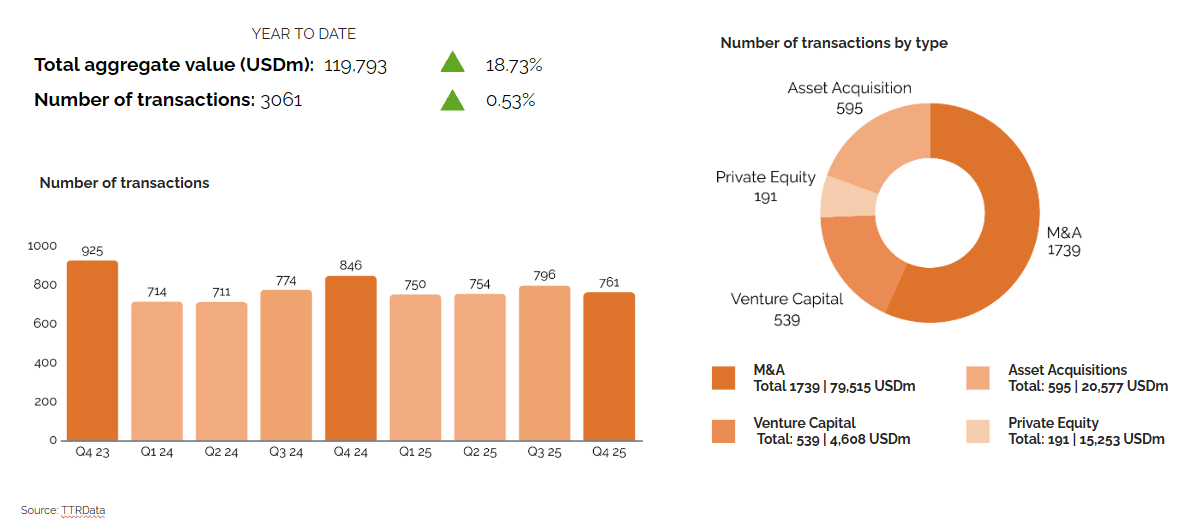

Latin America: resilient and increasingly focused

In Latin America, M&A activity reflected a selective but resilient environment.

Brazil consolidated its leadership, while Mexico, Argentina and Colombia formed a stable second tier of activity. Within tech, fintech, SaaS and AI-enabled services concentrated the majority of deal flow, highlighting sustained investor preference for scalable, revenue-generating platforms.

The regional market remains active — but increasingly focused on execution quality and strategic clarity.

M&A LatAm 2025 Overview

2026: Optimism returns — But capital is selective

Expectations for 2026 have turned cautiously optimistic. Improved financing conditions and stronger equity markets support higher anticipated activity levels.

However, growth is expected to remain selective. Investors are prioritizing business models that combine scalable growth with profitability discipline. Emerging markets may attract increased attention as developed market growth moderates, creating differentiated opportunities across select regions.

AI is also entering a new phase. The rise of agentic AI — autonomous systems capable of executing workflows rather than merely assisting — is likely to reshape enterprise M&A priorities across consulting, IT services and software.

The bottom line

This is not a volume-driven cycle.

It is a scale-driven, quality-driven cycle — where strategic positioning, profitability and execution readiness determine outcomes.

To explore the full analysis, sector breakdowns and 2026 outlook, access the complete Tech M&A – 2025 Full Year Report.

Subscribe to our Newsletter

Subscribe to receive the most important M&A updates for the tech sector in LatAm every month.