Ranking Tech M&A Latin America

Deals and investments December 2025

Overview 2025 – M&A market in LatAm

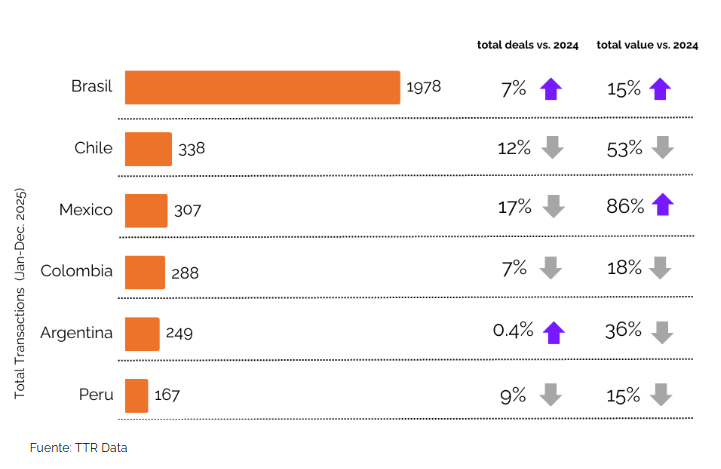

Latin America’s M&A market closed 2025 with solid momentum, totaling 3,061 announced and closed transactions and an aggregate value of USD 119.8B through Q4. Compared to 2024, deal volume increased marginally (+1%), while total value rose sharply (+19%), confirming a year characterized by fewer but larger and more strategic transactions.

M&A Tech LatAm overview – Dec ’25

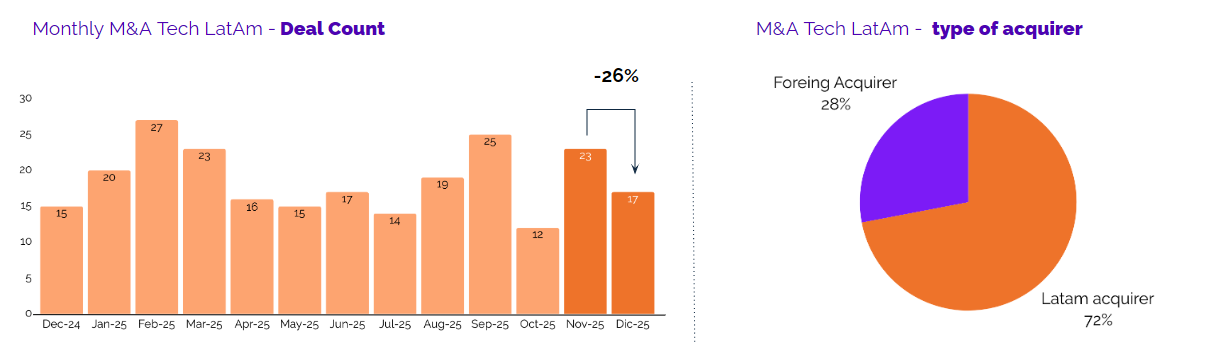

Tech M&A activity in Latin America softened in December 2025, totaling 17 transactions, down from November’s rebound of 23 deals. The pullback reflects typical year-end seasonality, as many processes closed earlier in Q4 and remaining transactions shifted into early 2026 pipelines.

Trends by country

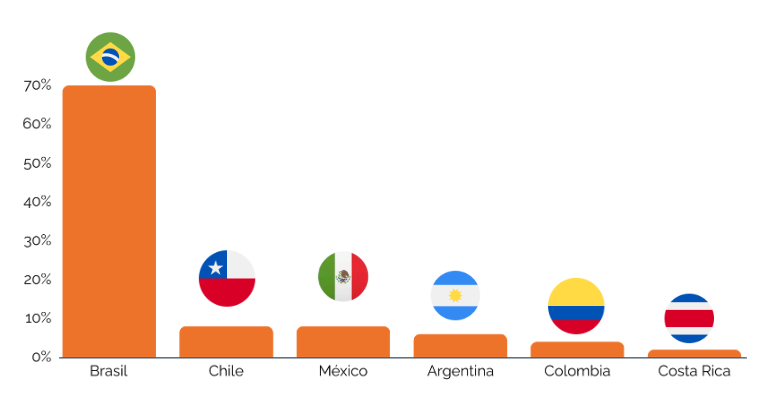

The December breakdown confirms the persistent concentration of deal activity in Brazil, which closed the year at levels above its Q4 average. At the same time, the recurring presence of Chile, Mexico, Argentina, and Colombia—albeit with smaller individual shares—highlights a stable secondary layer of regional activity, suggesting gradual diversification even as Brazil remains the clear anchor of LatAm tech M&A.

Trends by vertical industry

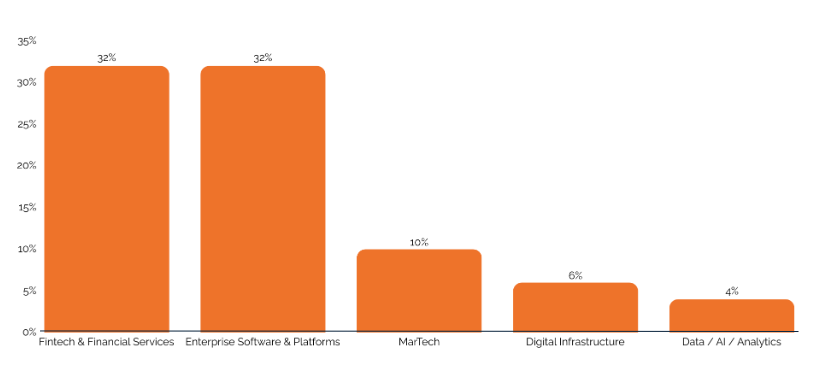

December’s sector mix highlights a clear year-end focus on core, revenue-critical platforms, with buyers concentrating on financial services and enterprise software as primary consolidation targets. The presence of MarTech and Digital Infrastructure points to selective bets on growth enablement and scalability, while lower—but persistent—activity in Data & AI reflects disciplined investment in advanced capabilities rather than broad-based experimentation heading into 2026.

Explore the full report below for deeper insights and a breakdown of tech deals and investments by country and sector.

Subscribe to our Newsletter

Subscribe to receive the most important M&A updates for the tech sector in LatAm every month.