Ranking Tech M&A Latin America

Deals and investments august 2025

Overview of M&A market in LatAm

Latin America’s M&A market recorded 1,855 transactions in the first eight months of 2025, with an aggregate value of US $65.3 billion. This reflects a 5% decline in deal volume compared to the same period in 2024, alongside a solid 21% increase in value—underscoring a market driven by fewer but larger and more strategic transactions. – In August alone, the region registered 214 deals worth US $5.8 billion.

M&A Tech LatAm overview

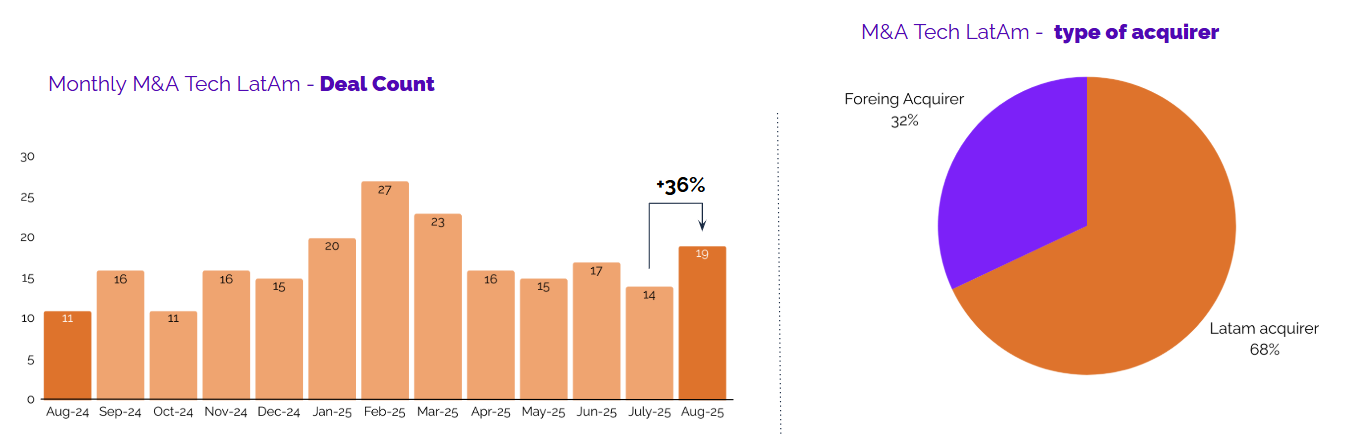

August 2025 recorded 19 tech M&A transactions in Latin America—up from July (14) and the highest monthly count since March (23), though still below the February peak (27). The rebound points to renewed activity after a softer start to Q3.

Trend insight: Over the past 12 months, monthly deal volume has fluctuated between 11 and 27 transactions. With 166 deals recorded since January 2025, the market continues to show resilience despite short-term volatility, driven by regional consolidation and strategic acquisitions.

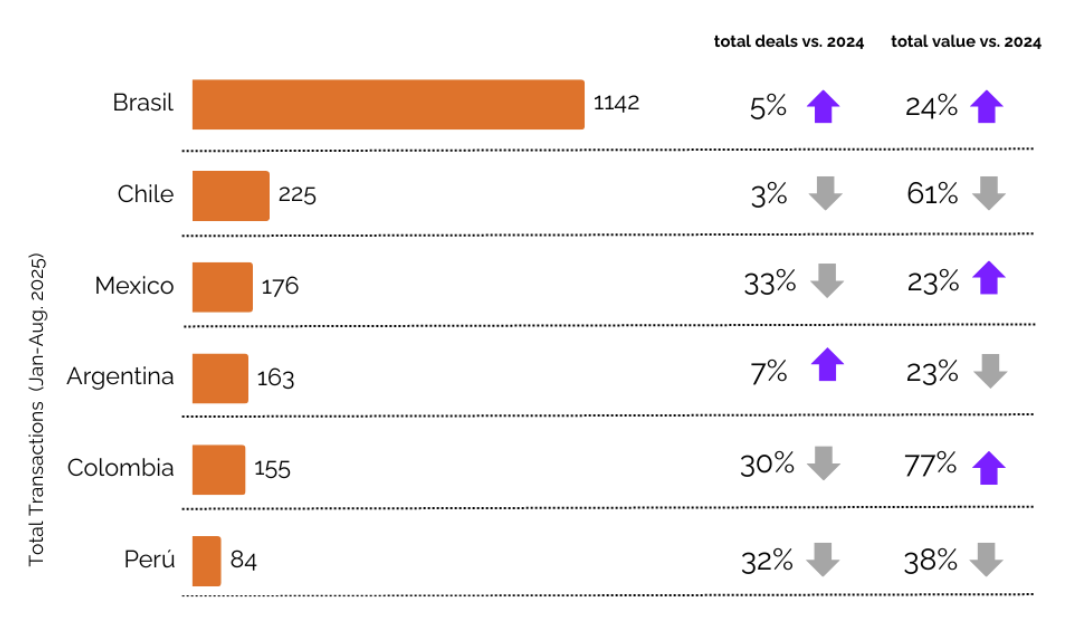

Trends by country

Brazil remained the clear leader in tech M&A activity in August 2025, accounting for nearly 70% of all transactions—its highest share since March. Mexico ranked second with 9%, followed by Chile at 6%, Argentina at 5%, and Colombia at 3%.

Trend insight: While Brazil continues to dominate the regional landscape, August data shows a pullback in activity outside the country compared to July, when Mexico and Colombia reached double-digit shares.

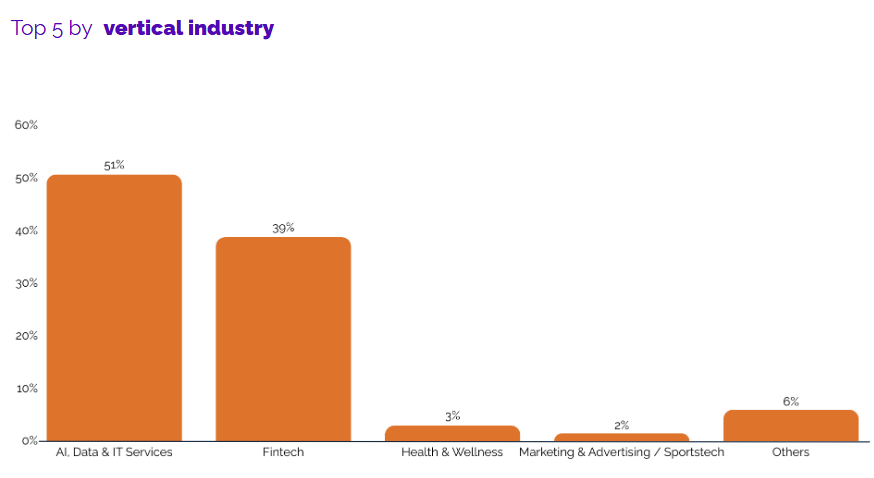

Trends by vertical industry

AI, Data & IT Services dominated tech M&A activity in August 2025, representing 51% of all transactions. Fintech followed with 39%, while Health & Wellness accounted for 3%. Marketing & Advertising together with Sportstech captured 1.5%, and other verticals made up the remaining 6%.

Trend insight: The surge of AI, data, and IT services highlights their growing role as the region’s strategic priority, surpassing fintech’s traditional dominance. The limited activity in health, marketing, and sportstech reflects a more concentrated landscape, with high-impact verticals driving the bulk of dealmaking.

Explore the full report below for deeper insights and a breakdown of tech deals and investments by country and sector.

Subscribe to our Newsletter

Subscribe to receive the most important M&A updates for the tech sector in LatAm every month.