Ranking Tech M&A Latin America

Deals and investments may 2025

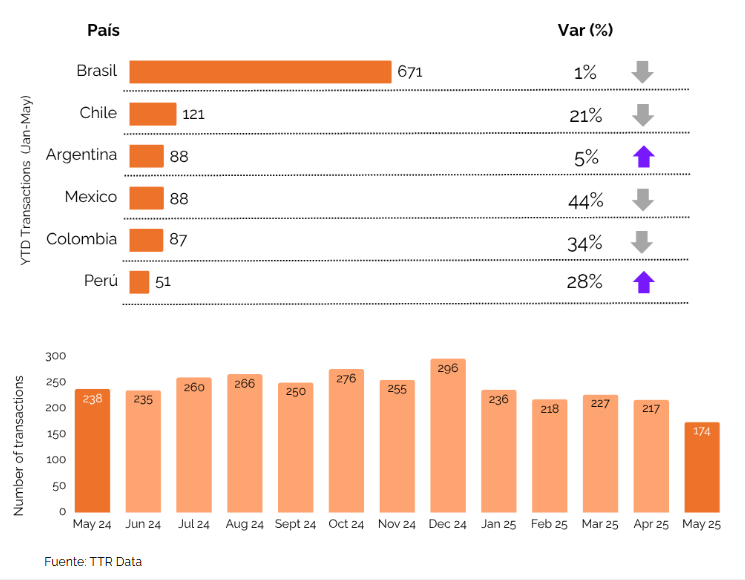

Overview of M&A market in LatAm

In May 2025 alone, the market registered 174 transactions, totaling USD 15.4 billion, the highest monthly deal value so far this year.

Argentina was the only country with positive growth in both volume and value, recording 88 transactions (+5%) and a 55% increase in capital mobilized (USD 3.2B). Colombia also showed a slight increase in value (+2%), although it dropped one position in the regional ranking.

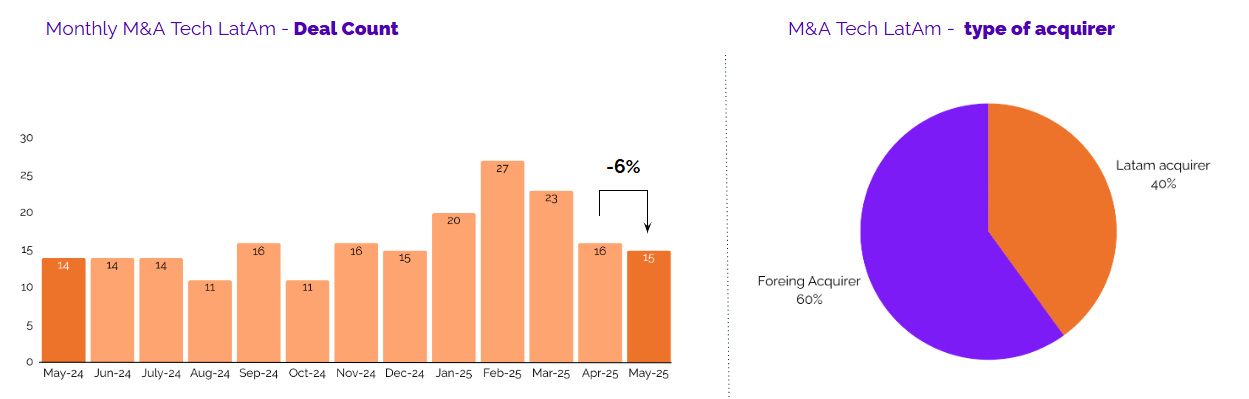

M&A Tech LatAm overview

May 2025 recorded 15 tech M&A transactions in Latin America—a slight decline from April (16) and well below the Q1 peak (27 in February).

After three consecutive months of LatAm buyers leading the market, May marked a clear shift, with foreign acquirers regaining majority share for the first time since 2024. This may reflect renewed international interest in strategic tech assets across the region.

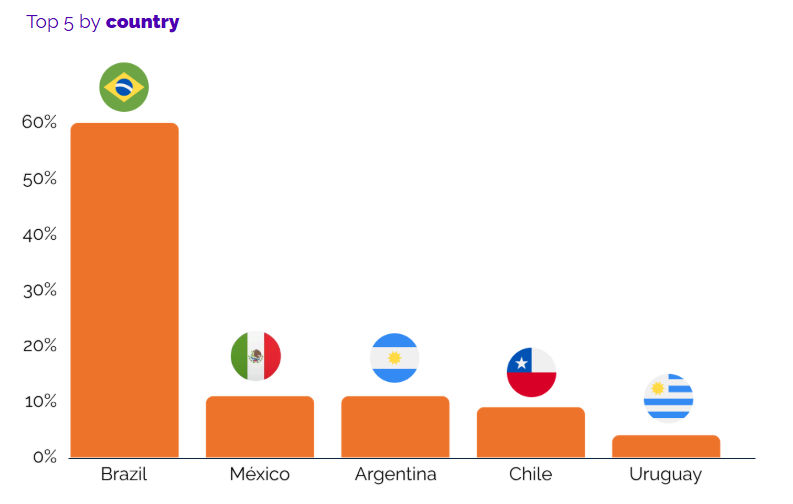

Trends by country

Brazil remained the regional leader in tech M&A activity in May 2025, accounting for 60% of all transactions—its lowest share so far this year, reflecting a broader regional spread.

Trend insight: While Brazil continues to dominate, deal activity is gradually diversifying across the region, with Mexico and Argentina showing renewed momentum and Uruguay making a notable return to the ranking

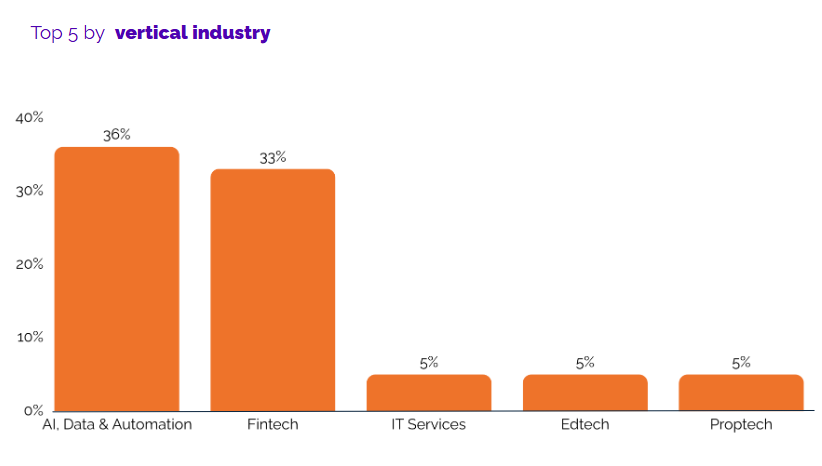

Trends by vertical industry

In May 2025, AI, Data & Automation emerged as the leading sector, accounting for 36% of all tech M&A activity—its highest share in over a year. Fintech followed closely at 33%, maintaining its position as a consistently active vertical in the region.

Deals and investments:

Amid sustained sector momentum, the following standout transactions and funding rounds in April exemplify where capital and strategic interest are converging in LatAm’s tech ecosystem.

Top 5 deals:

- Visma acquired Lara AI (🇦🇷) to integrate AI-driven capabilities into its HR software suite, reinforcing its leadership in mission-critical enterprise solutions across Latin America.

- Nuvini acquired Munddi (🇧🇷), enhancing its B2B SaaS ecosystem and enabling cross-selling opportunities across its suite of marketing and sales platforms.

- Colegium acquired KidsBook (🇨🇱) to strengthen its early education portfolio and digitize communication between parents and preschool teachers.

- Visma Latam acquired Rindegastos (🇨🇱), expanding its financial software offering and SME reach with a leading expense management platform.

- iFood acquired Opdv, 3S Checkout, and Saipos (🇧🇷) to consolidate its position as an all-in-one restaurant tech platform, bridging in-store and online operations.

Top 5 investments:

- Clara raised $80M (🇲🇽) in a round led by Citi and KASZEK to strengthen its corporate spend platform and accelerate its expansion in Brazil.

- Credicuotas raised $33M (🇦🇷) via a bond issuance to expand consumer lending services amid Argentina’s evolving credit environment.

- Calice raised $2.5M (🇦🇷) to grow its AI-driven agtech platform NODES, scaling across Brazil and the U.S. with a focus on smart, sustainable farming.

- VMetrix raised $3.2M (🇨🇱) in seed funding to expand operations and enhance its AI-powered wealth management platform.

- KiwiPay raised $10M (🇵🇪) to scale its healthcare-focused digital payments platform across Latin America, backed by HFD, MVRK Capital, and WDC Genesis.

Final takeaway:

Despite a continued cooldown in deal count, the LatAm tech M&A landscape remains active, with foreign buyers regaining majority share for the first time since 2024.

May highlighted the dominance of AI and data-driven solutions, a resilient fintech vertical, and a more diverse geographic spread—with Argentina, Mexico, and Uruguay gaining ground as Brazil’s share slightly declined.

On the investment side, corporate spend, legaltech, and agfintech attracted significant funding, signaling confidence in vertical-specific innovation across the region.

Explore the full report below for deeper insights and a breakdown of tech deals and investments by country and sector.

Subscribe to our Newsletter

Subscribe to receive the most important M&A updates for the tech sector in LatAm every month.