Ranking Tech M&A Latin America

Deals and investments april 2025

Overview of M&A market in LatAm

Between January and April 2025, Latin America recorded 858 M&A transactions, reflecting a 10% year-over-year decline in deal volume. Despite macroeconomic caution and valuation recalibrations, April alone saw 191 deals totaling USD 6.675 billion in disclosed value—signaling continued strategic activity across sectors.

Argentina and Colombia were the only countries to post positive growth in capital mobilized, pointing to localized momentum in an otherwise cautious regional landscape.

M&A Tech LatAm overview

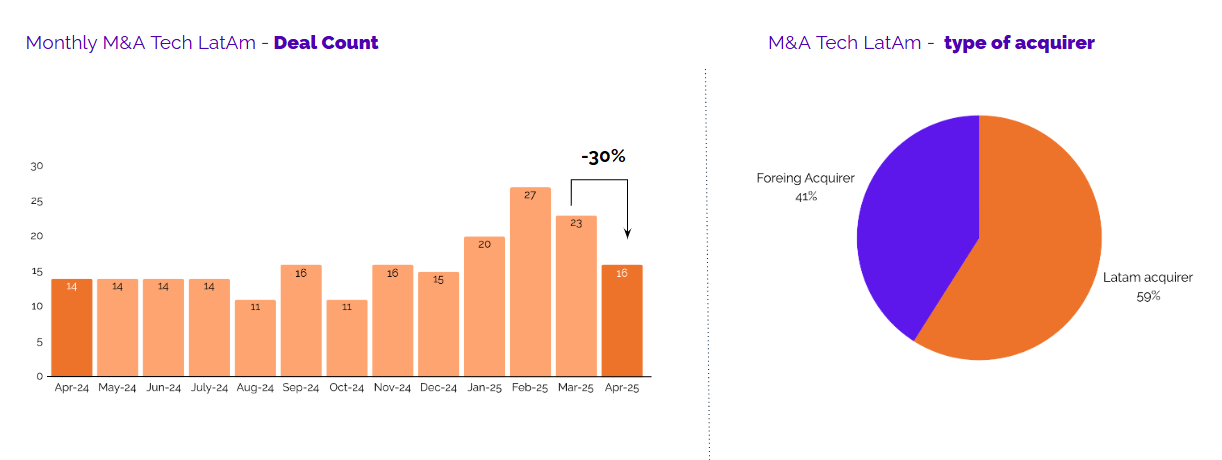

Tech-related M&A in April saw a modest slowdown, with 16 transactions, down from 23 in March and 27 in February. However, deal count remains above late-2024 levels, indicating a more stable baseline of activity.

59% of transactions were led by LatAm-based acquirers, underscoring the region’s strong internal appetite for inorganic growth. Meanwhile, foreign buyers regained some ground, reflecting selective re-entry into the region amid improving local fundamentals.

Trends by country

-

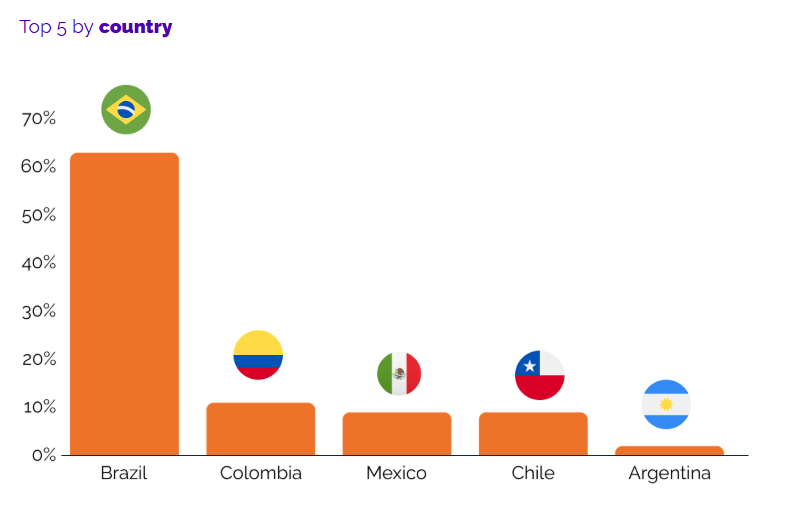

Brazil maintained its lead, accounting for 63% of April tech M&A activity, though this marks a slight drop from March (68%).

- Colombia doubled its share of transactions from 7% to 11%, driven by high-impact AI and software deals.

- Mexico and Chile each represented 9% of the deal flow, showing consistent engagement from local and regional buyers.

- Argentina slipped to 2%, its lowest monthly share YTD, despite strong performance in the general M&A market.

Trends by vertical industry

-

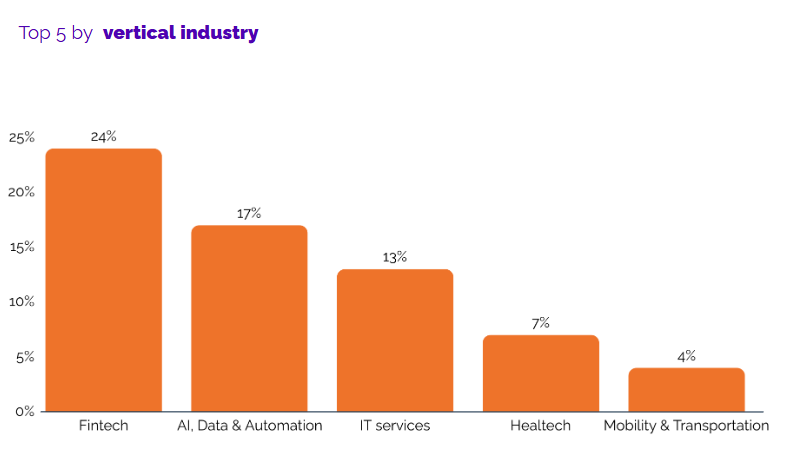

Fintech remained the most active vertical in April, accounting for 24% of tech M&A activity. While slightly down from 28% in March, it continues to attract investor attention thanks to sustained demand for digital financial solutions across the region.

- AI, Data & Automation emerged strongly at 17%, up from a lower base in March, highlighting a growing appetite for predictive technologies and process automation.

- IT Services gained ground at 13%, underscoring increased interest in end-to-end infrastructure, cloud migration, and outsourcing solutions.

- Meanwhile, Healthtech rose modestly to 7%, and Mobility & Transportation returned to the top five with 4%, reflecting renewed focus on logistics, smart mobility, and regional transport optimization.

Deals and investments:

Amid sustained sector momentum, the following standout transactions and funding rounds in April exemplify where capital and strategic interest are converging in LatAm’s tech ecosystem.

Top 5 deals:

- With support from Valio Ventures, InfoControl joins Bridgepoint-backed Achilles in a strategic deal.

-

Blend360 (USA) acquired Nuvu (Colombia) – Strategic move to establish Colombia as its LatAm AI hub. Plans to scale local team from 100 to 1,000.

- ActiveCampaign (USA) acquired Hilos (Mexico) – Strengthens conversational commerce capabilities via WhatsApp automation.

- Banorte (Mexico) acquired RappiCard México – $50M deal to boost digital banking and credit card offerings.

- Mevo (Brazil) acquired Receita Digital – Expands digital prescription capabilities after R$140M Series B.

- MOOVA (Argentina) acquired VONZU Tech (Spain) – Expands logistics automation offering in LatAm and Europe.

Top 5 investments:

-

Felix (Guatemala) – Raised $75M in a Series B led by QED Investors to expand digital lending across Central America.

- Kavak (Mexico) – Closed a $127M down round, adjusting valuation to $2.2B while reinforcing operations.

- Onfly (Brazil) – Secured R$240M from Tidemark to support expansion in Colombia, Chile, and Argentina.

- Toku (Chile) – Raised $48M Series A to scale its payment management platform, with growth plans in Brazil.

- Finaktiva (Colombia) – Landed $10M from BBVA Spark to strengthen SME lending infrastructure.

Final takeaway:

Despite a measured slowdown in deal volume, the LatAm tech M&A ecosystem remains fundamentally active, with regional buyers leading consolidation efforts and foreign players selectively re-engaging. April highlighted the resilience of fintech, the rise of AI and data-driven solutions, and growing interest in Colombia and Central America.

Explore the full report below for deeper insights and a breakdown of tech deals and investments by country and sector.

Subscribe to our Newsletter

Subscribe to receive the most important M&A updates for the tech sector in LatAm every month.