Ranking Tech M&A Latin America

Deals and investments march 2025

Overview of M&A Market in LatAm

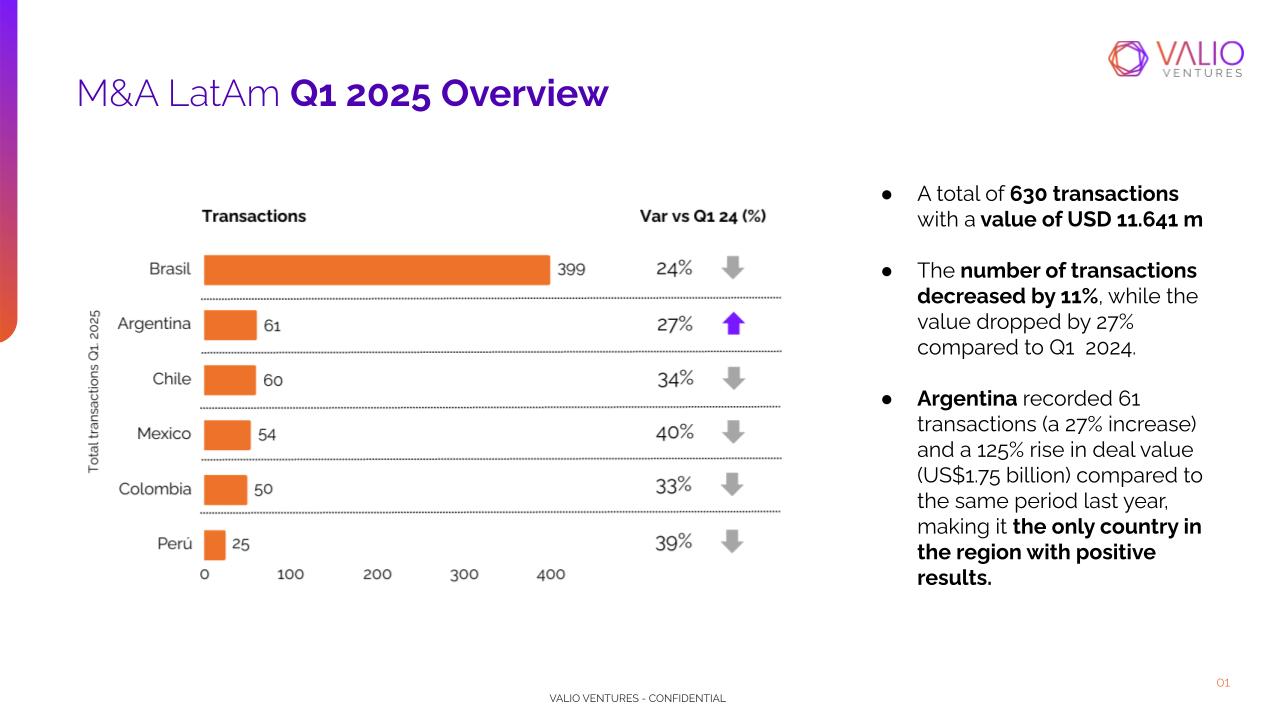

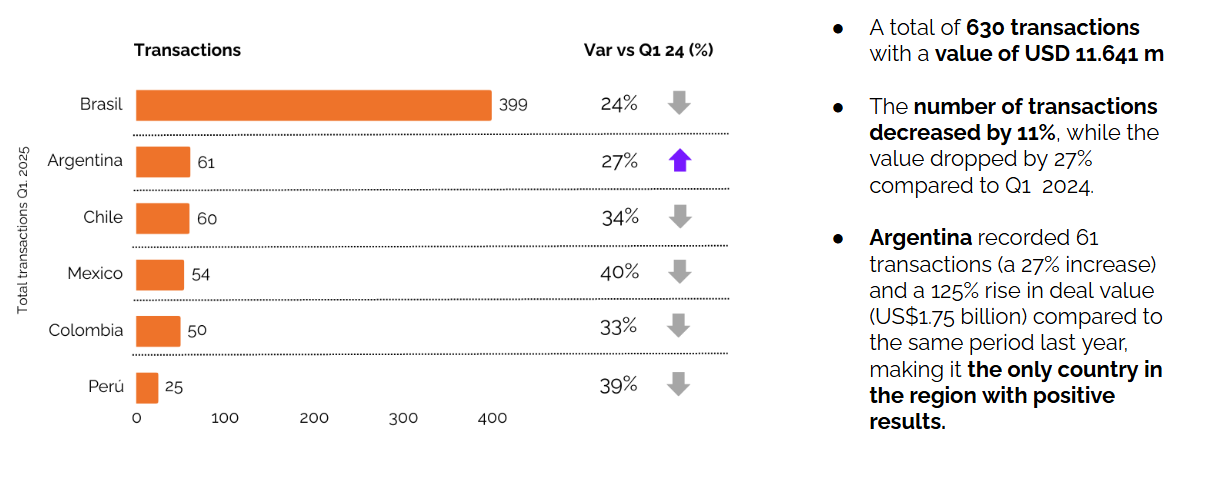

In Q1 2025, LatAm recorded 630 M&A transactions worth USD 11.6 billion, marking an 11% drop in deal count and a 27% decline in value versus Q1 2024. Despite the regional slowdown, LatAm Tech M&A showed resilience—tech deals rebounded after late-2024 lows, underscoring renewed investor interest in digital assets and services across the region.

M&A Tech LatAm Overview

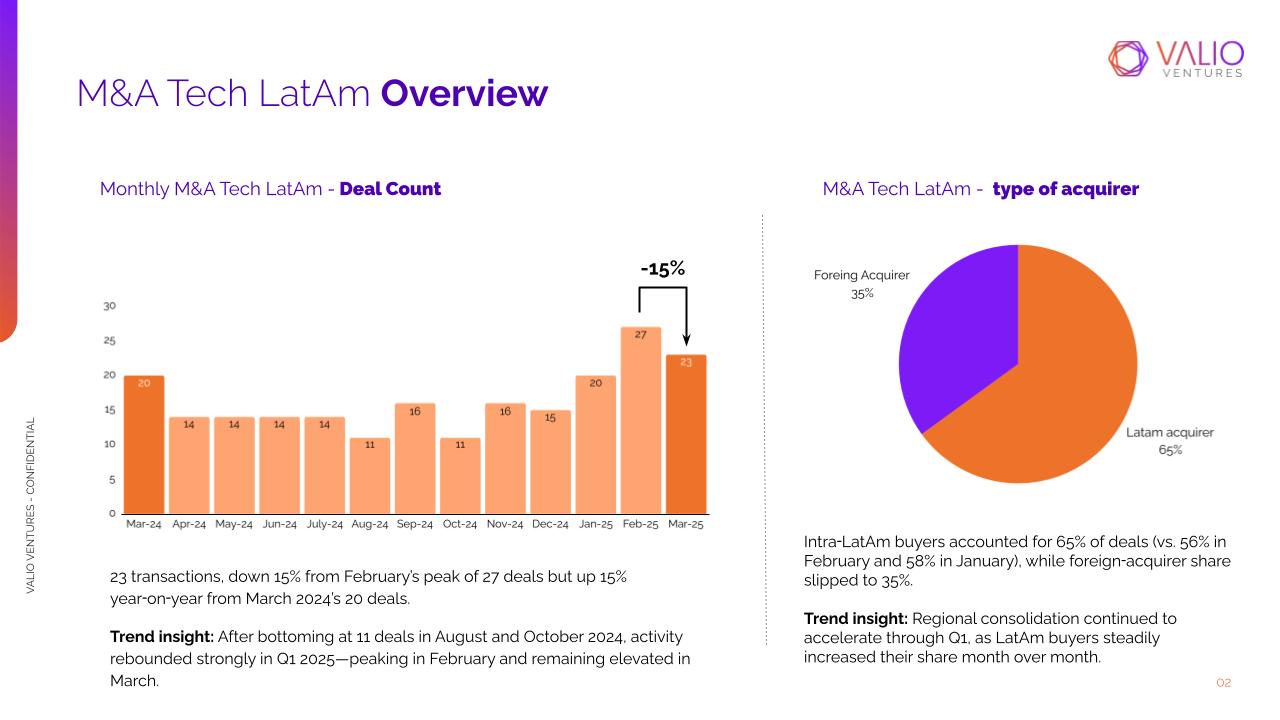

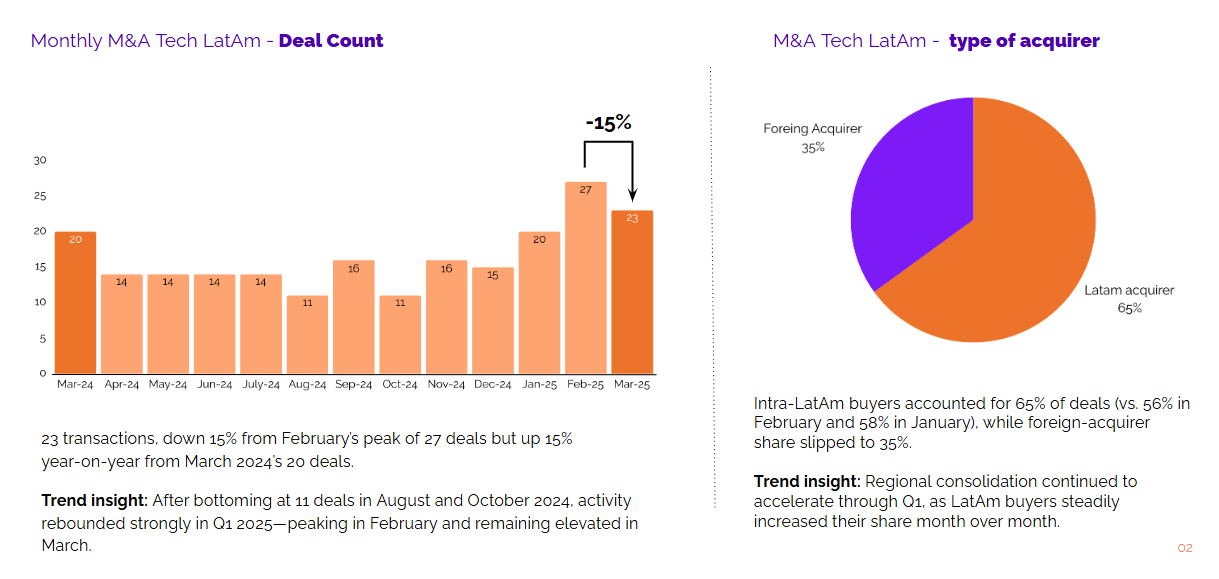

March saw 23 tech-sector deals in LatAm, down 15% from February’s 27 but up 15% year-on-year from March 2024’s 20 deals. Intra-regional acquirers accounted for 65% of these transactions (vs. 56% in February), highlighting accelerating consolidation among LatAm players.

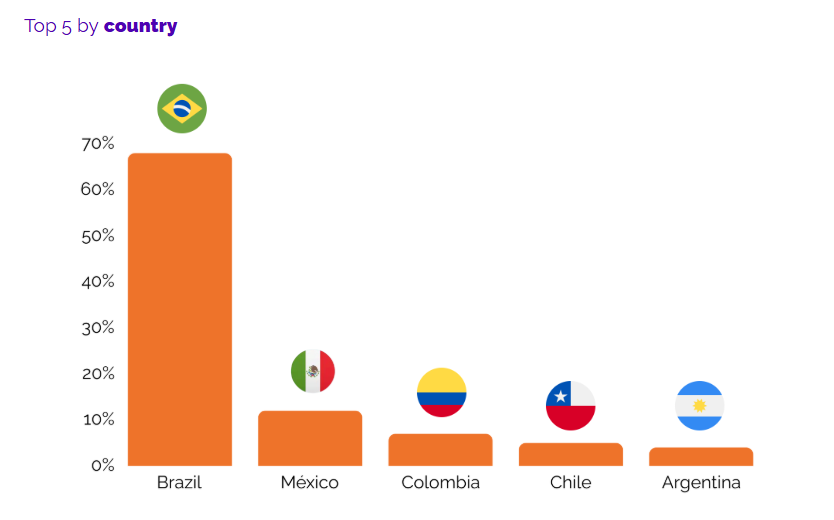

Trends by Country

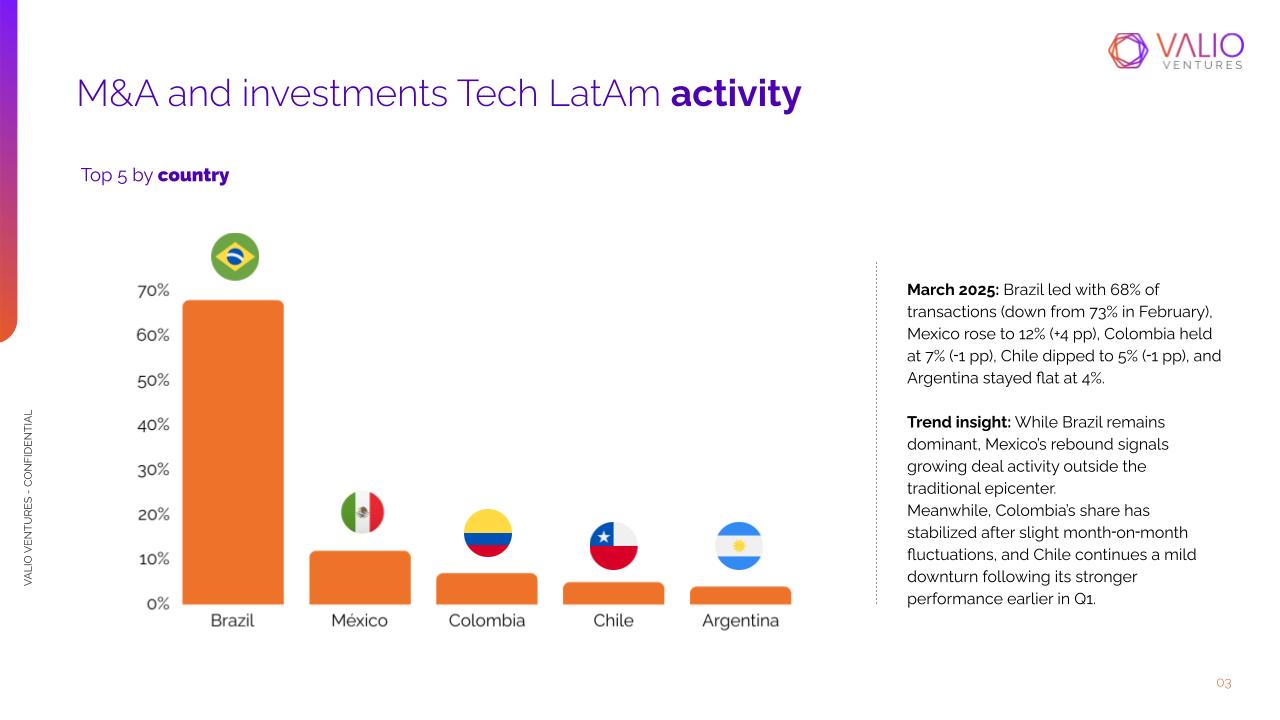

- Brazil: 68% share of tech M&A (down from 73% in Feb)

- Mexico: 12% share (+4 pp), signaling growing activity outside Brazil

- Colombia: Stable at 7% (–1 pp)

- Chile: 5% (–1 pp)

- Argentina: 4%, flat month-on-month

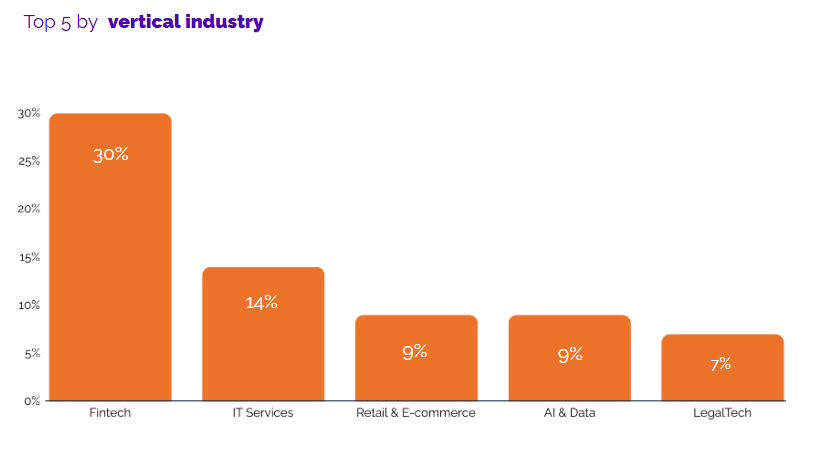

Trends by Vertical Industry

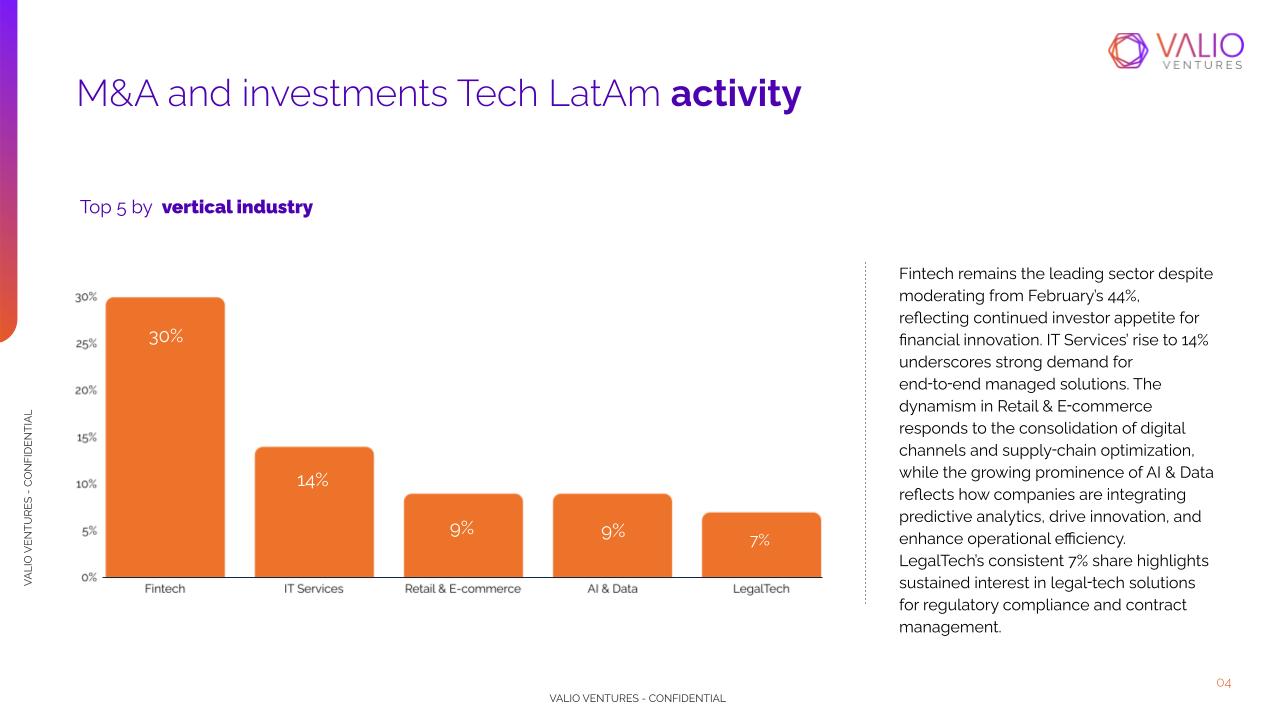

- Fintech: 30% of deals, remaining the top sector

- IT Services: 14%, reflecting demand for managed solutions

- Retail & E-commerce: 9%, driven by digital-channel consolidation

- AI & Data: 9%, as firms integrate analytics for innovation

- LegalTech: 7%, underscoring compliance and contract-management needs

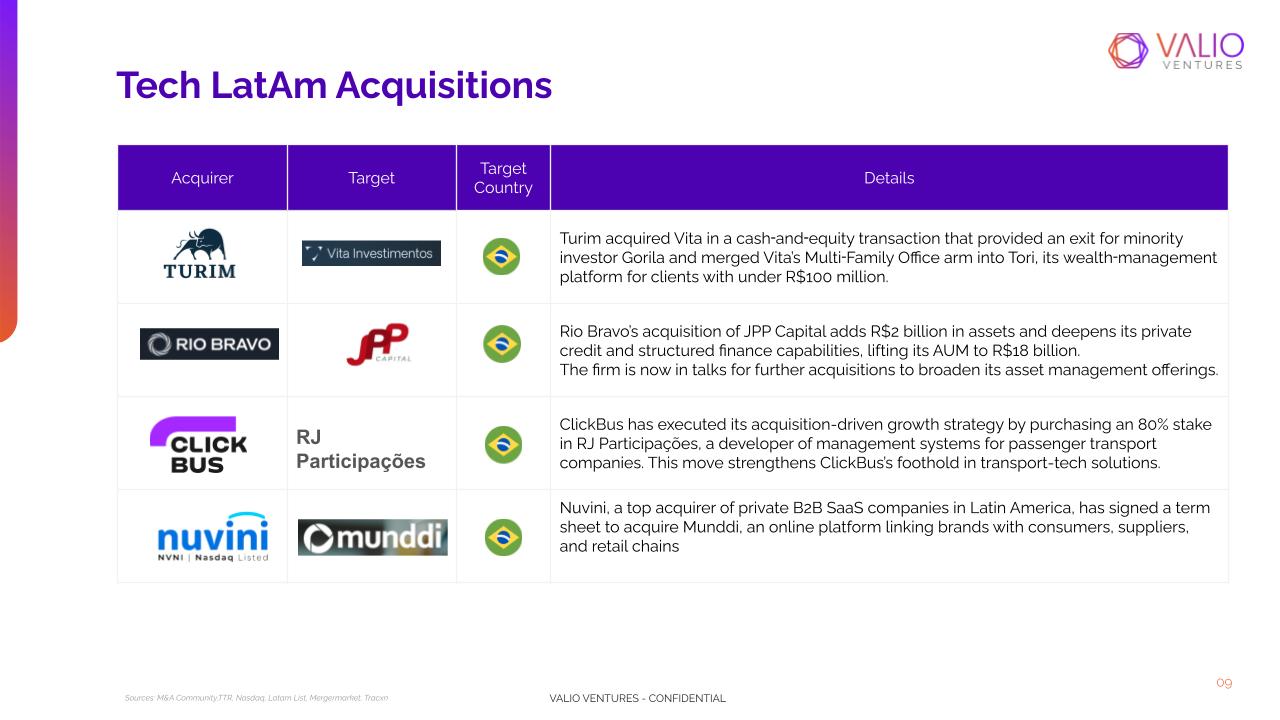

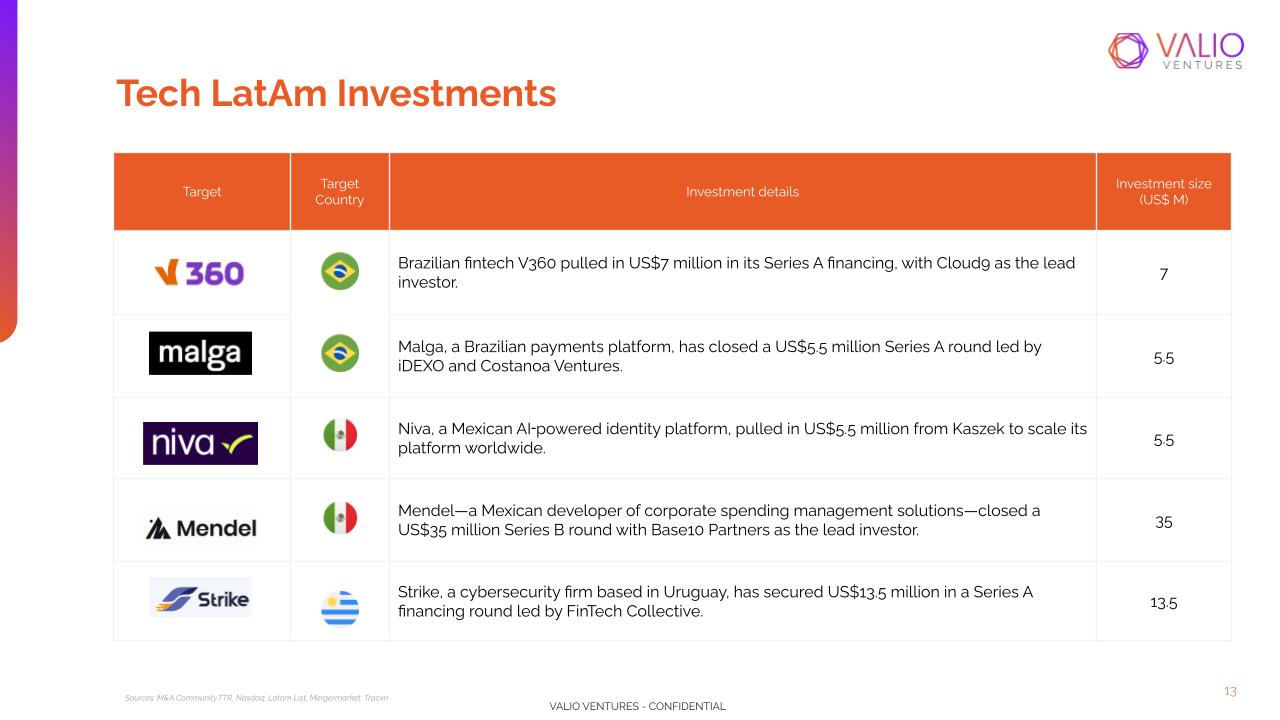

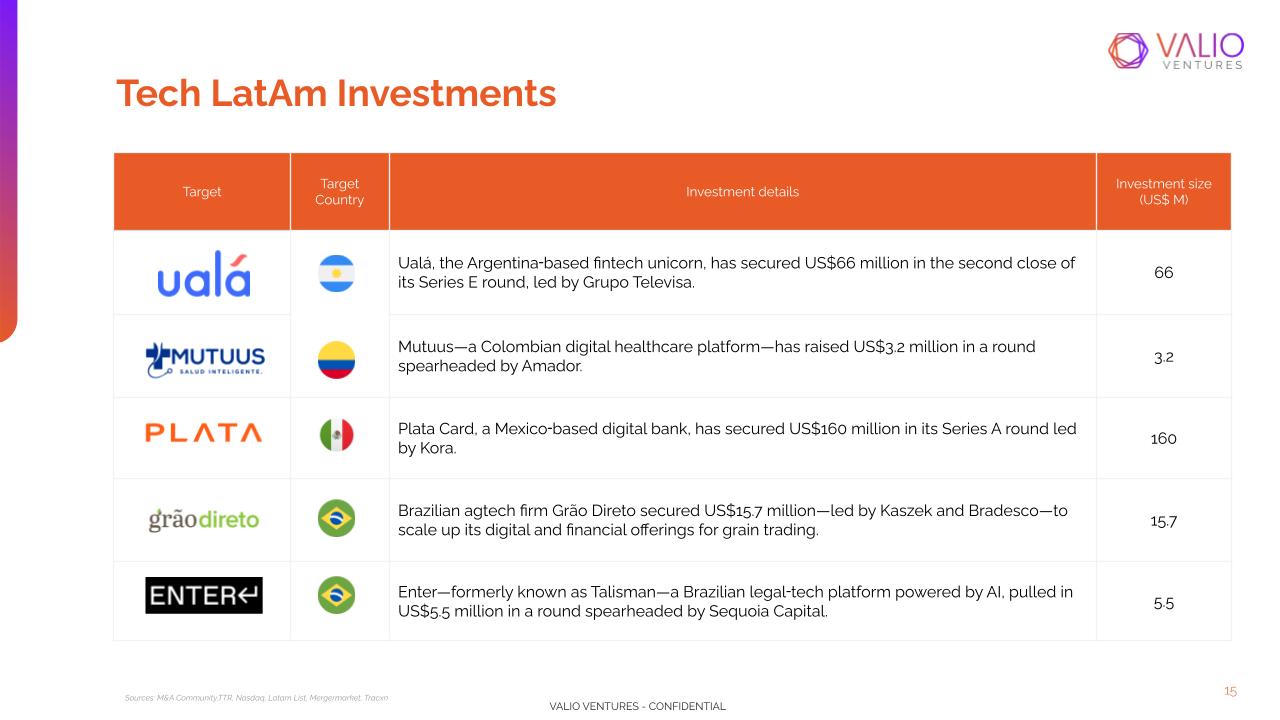

Deals and Investments:

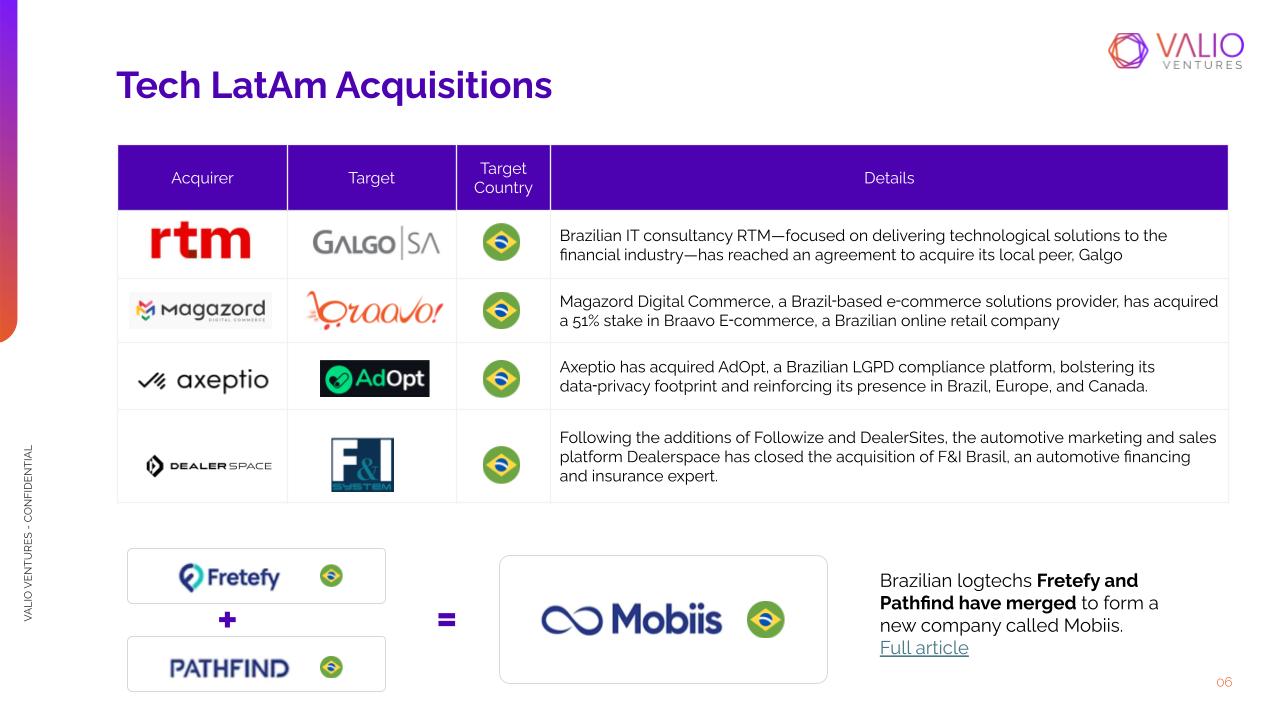

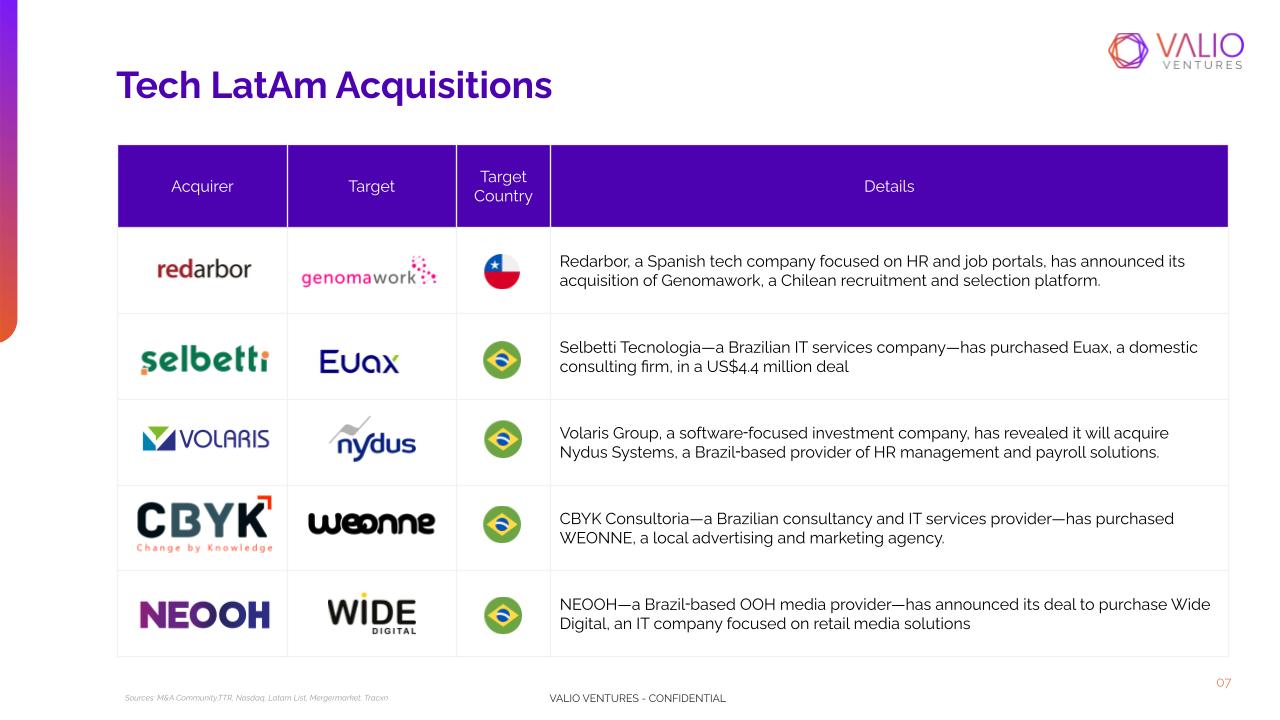

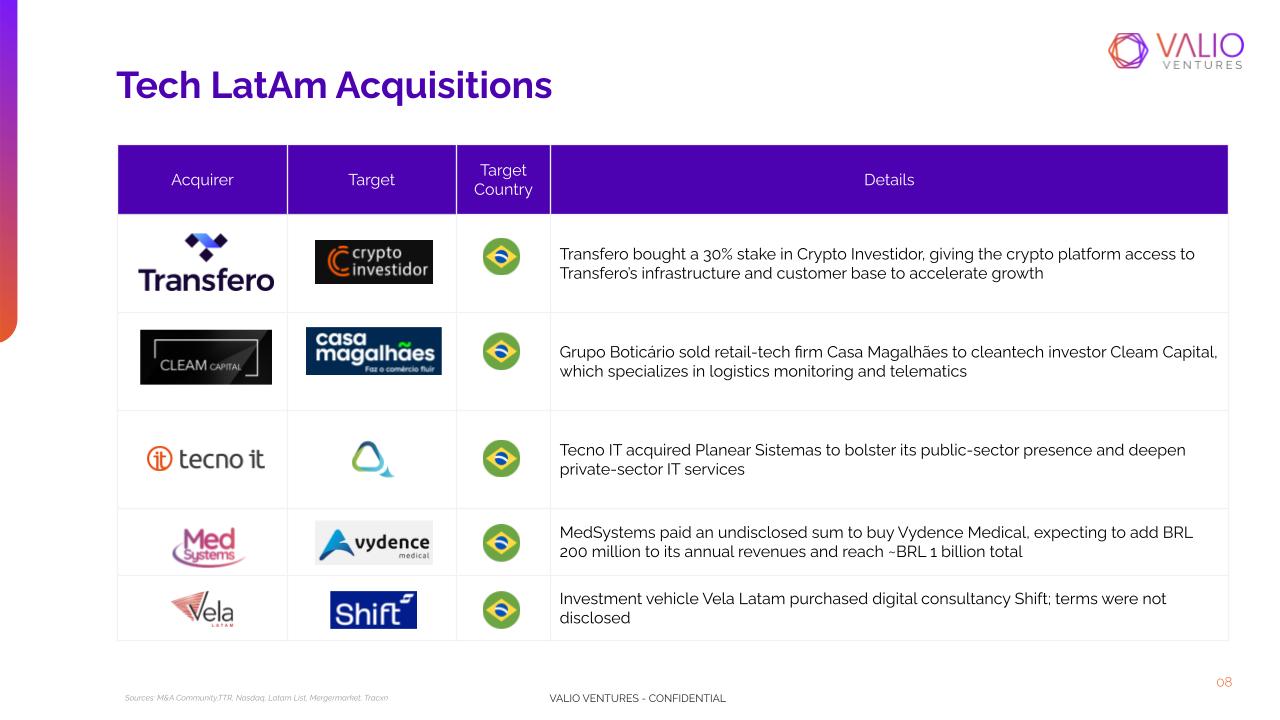

Amid sustained sector momentum, the following standout transactions and funding rounds in March exemplify where capital and strategic interest are converging in LatAm’s tech ecosystem.

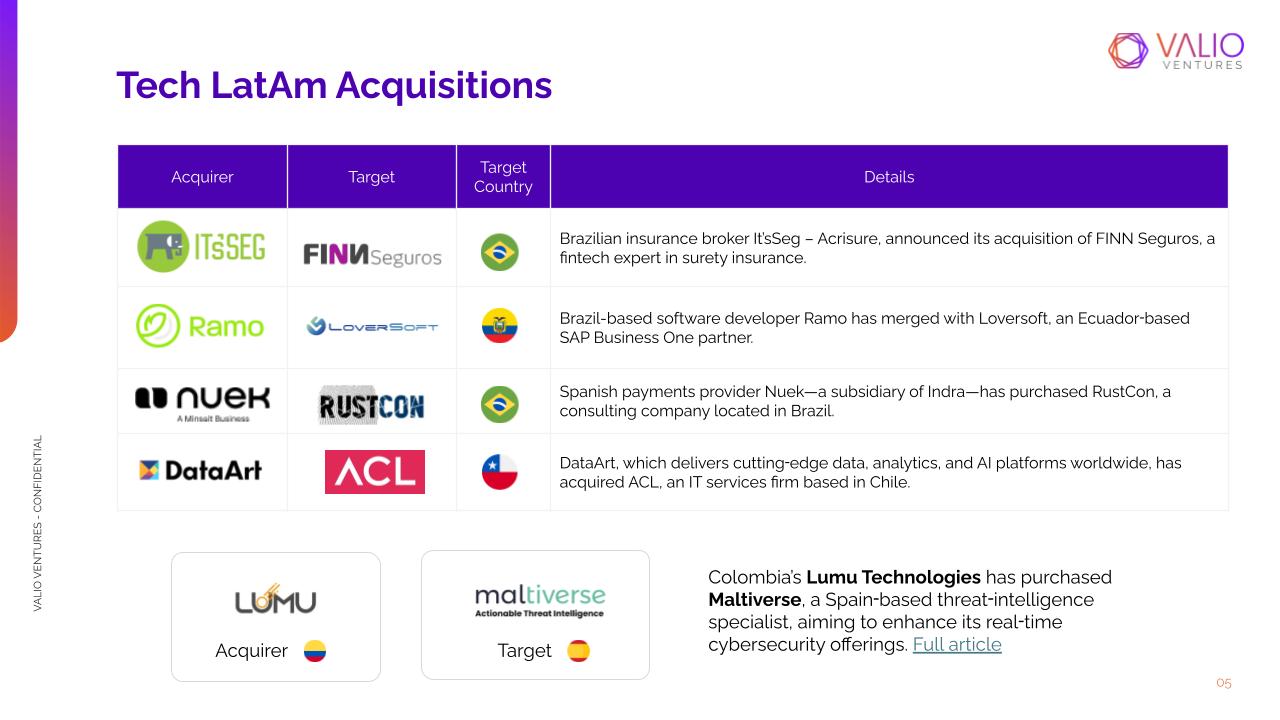

Top 5 Deals:

- Acrisure → FINN Seguros (Brazil) – surety-insurance fintech acquisition;

- Ramo → Loversoft (Brazil → Ecuador) – SAP Business One partner merger;

- Indra’s Nuek → RustCon (Spain → Brazil) – payments-provider bolt-on;

- DataArt → ACL (USA → Chile) – analytics & AI platform expansion;

- Lumu Technologies → Maltiverse (Colombia → Spain) – real-time cybersecurity enhancement.

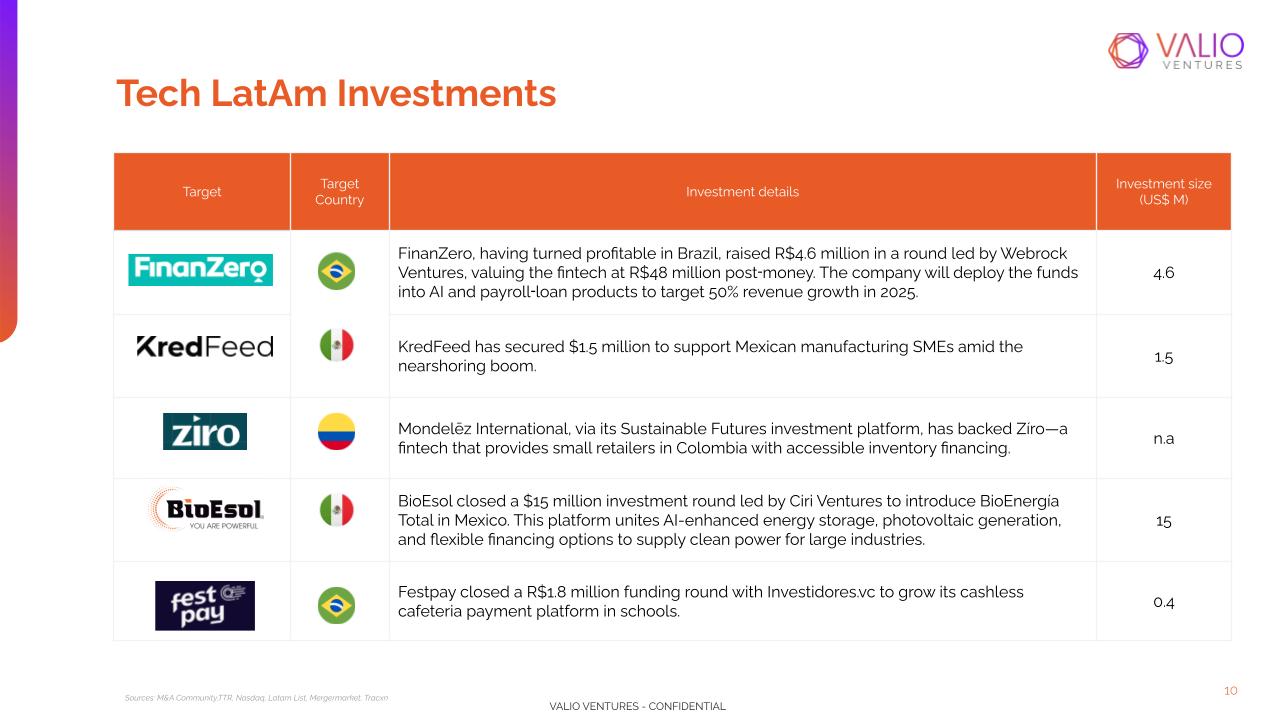

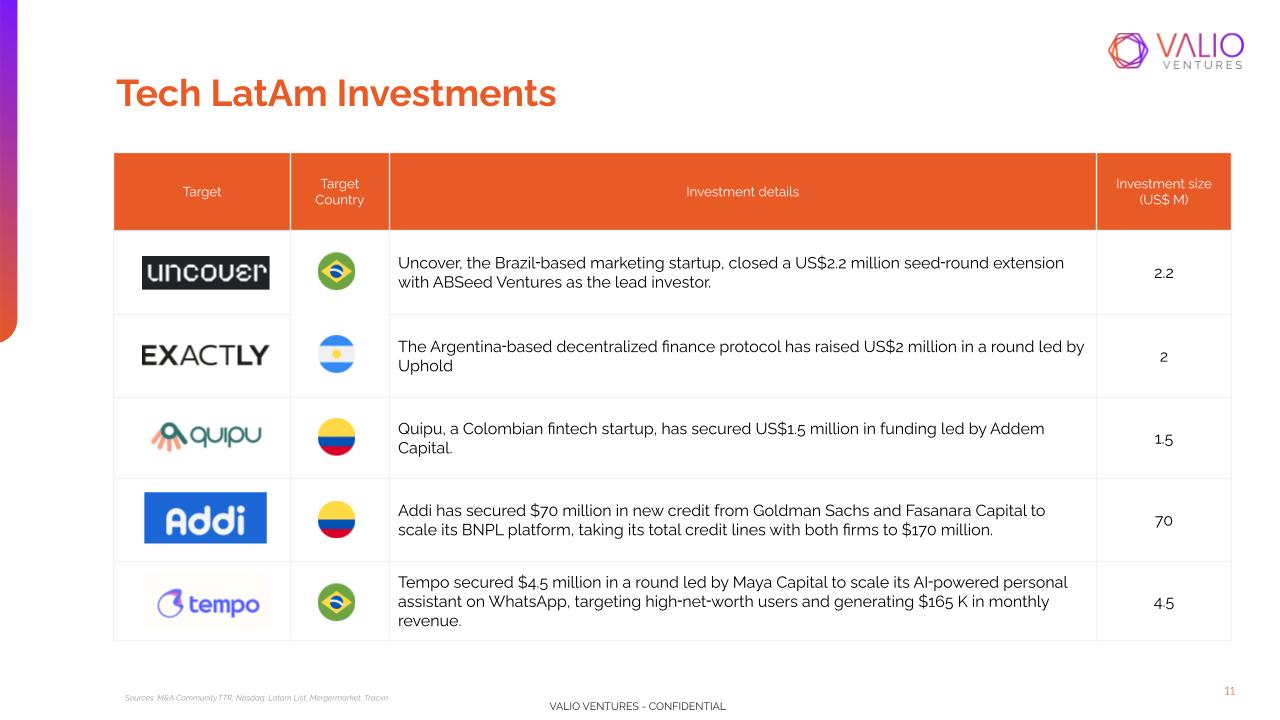

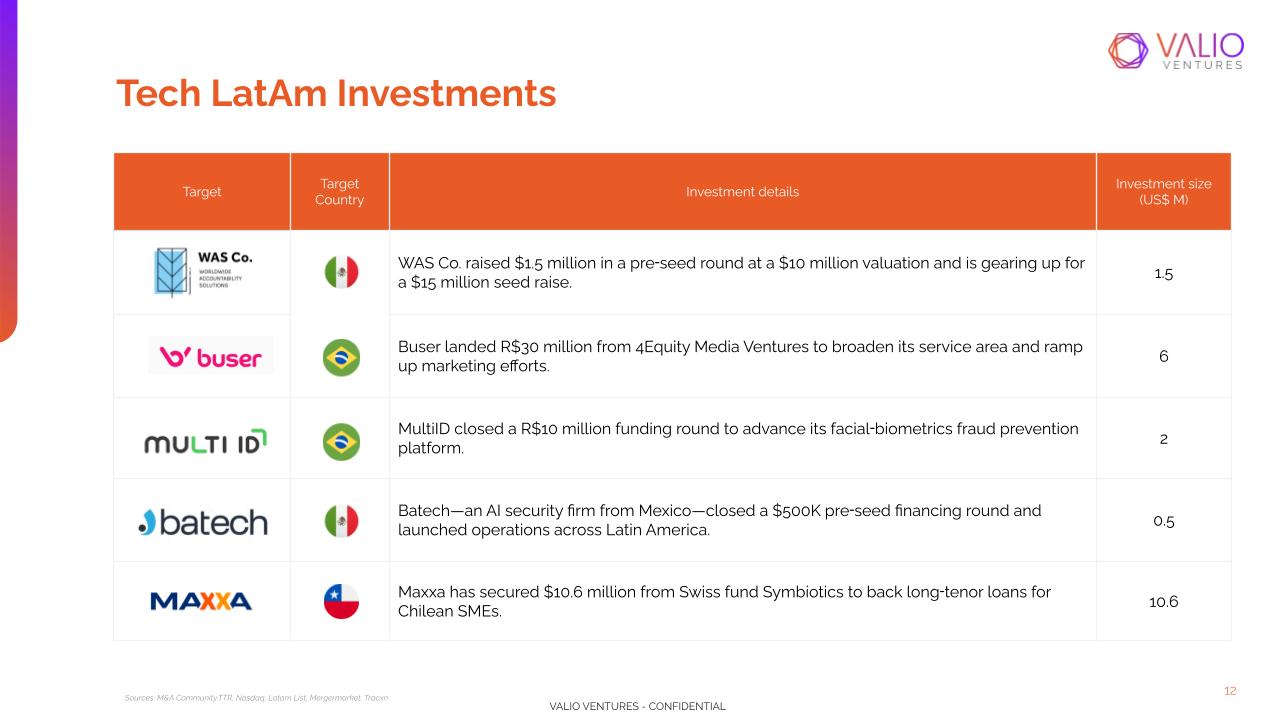

Top 5 Investments:

-

BioEsol (Mexico) – US$ 15 M for AI-enhanced energy storage & financing platform;

- FinanZero (Brazil) – R$ 4.6 M into AI and payroll-loan product expansion;

- Uncover (Brazil) – US$ 2.2 M seed-round extension;

- Argentinian DeFi Protocol (Argentina) – US$ 2 M round led by Uphold;

- KredFeed (Mexico) – US$ 1.5 M to support manufacturing SMEs amid nearshoring.

Wrapping Up:

March’s Tech M&A snapshot demonstrates that, even amid a broader market cooldown, digital-sector transactions in LatAm maintain upward momentum. Brazil remains the epicenter, but rising deals in Mexico and sustained intra-regional consolidation signal a diversifying landscape. As Q1 closes, tech investors and corporates should watch for opportunities in fintech innovation, managed IT services, and AI-driven platforms to drive the next wave of growth.

Subscribe to our Newsletter

Subscribe to receive the most important M&A updates for the tech sector in LatAm every month.