Ranking Tech M&A Latin America

Deals and investments february 2025

Tech M&A in LatAm defies market slowdown: February 2025 Overview

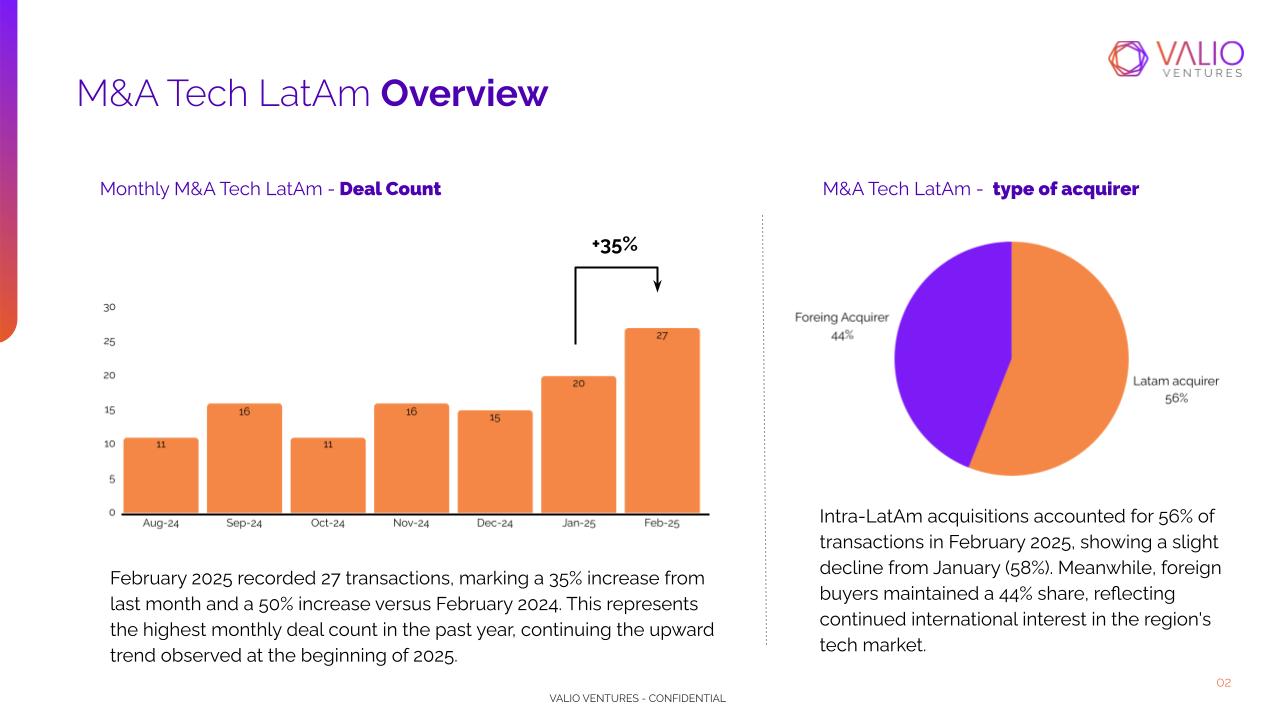

The M&A landscape in Latin America showed mixed results in February 2025. While the broader M&A market saw a decline, the technology sector continued to thrive. The general M&A market in LatAm experienced a 22% decrease in the number of transactions and a 47% drop in value compared to the previous year. In contrast, the technology sector demonstrated resilience, with a notable 35% increase in the number of deals from January, and a 50% year-over-year growth. This reflects the ongoing upward momentum in the Tech M&A market in the region.

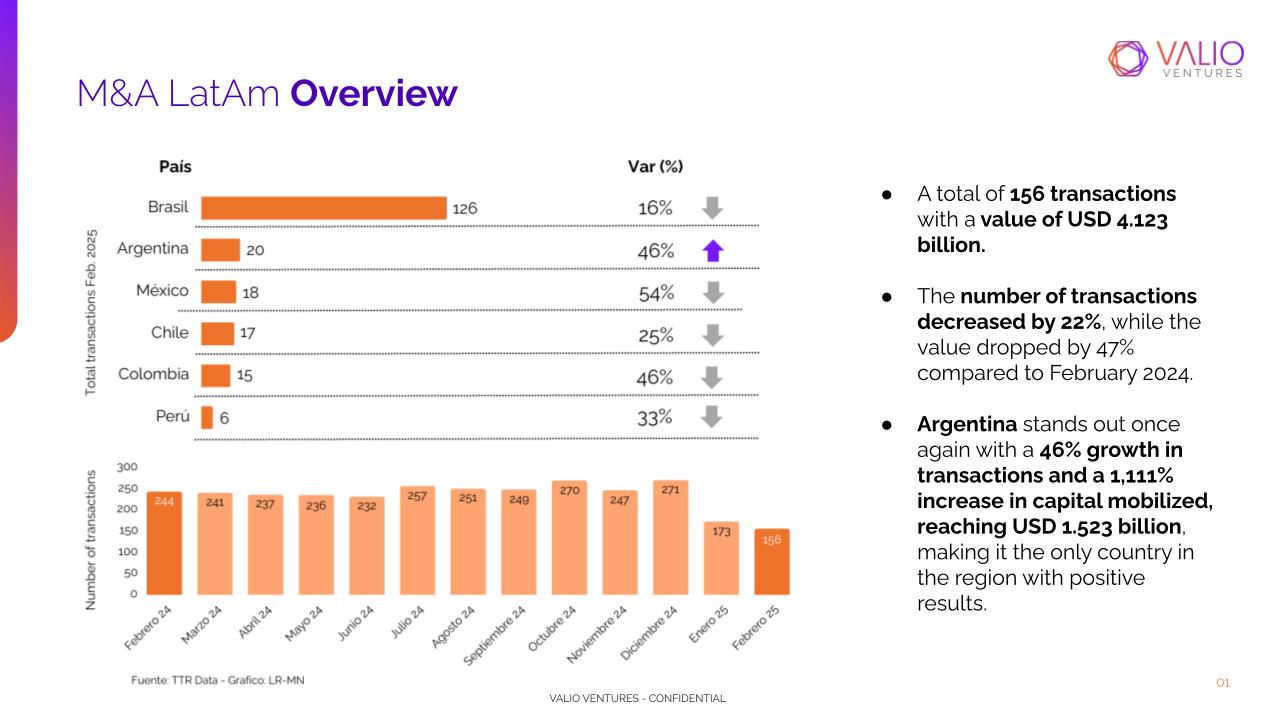

Overview of M&A Market in LatAm

In total, February 2025 recorded 156 transactions with a combined value of USD 4.123 billion. The number of transactions fell by 22%, and the total value dropped by 47% compared to February 2024. The standout performer in this landscape was Argentina, which saw a 46% increase in transactions and a staggering 1,111% growth in capital mobilized, reaching USD 1.523 billion. Argentina was the only country in the region to report positive results, marking it as a notable exception amidst the overall slowdown.

M&A Tech LatAm Overview

The Tech sector in Latin America continued its upward trend in February 2025, with 27 transactions recorded—a 35% increase from the previous month and a 50% rise compared to February 2024. This marked the highest deal count in the past year, demonstrating continued growth in the sector. In terms of acquirer type, intra-LatAm acquisitions accounted for 56% of the deals in February 2025, a slight dip from 58% in January. Foreign buyers maintained a 44% share, signaling that international interest in Latin America’s tech market remains strong..

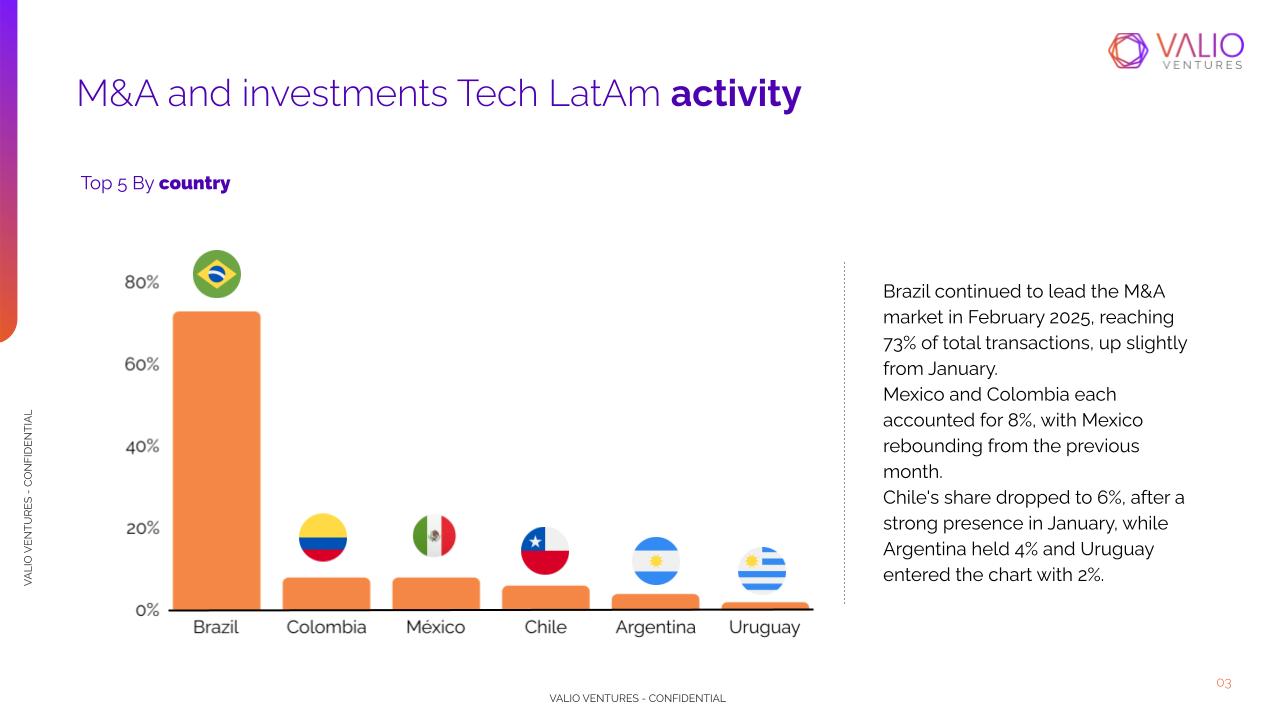

Trends by Country

Brazil remained the dominant player in the region’s M&A market, accounting for 73% of all transactions in February, slightly up from January. Mexico and Colombia each held 8% of the market, with Mexico rebounding from a weaker performance in January. Chile’s share dropped to 6%, following a strong January, while Argentina and Uruguay represented 4% and 2% of the market, respectively.

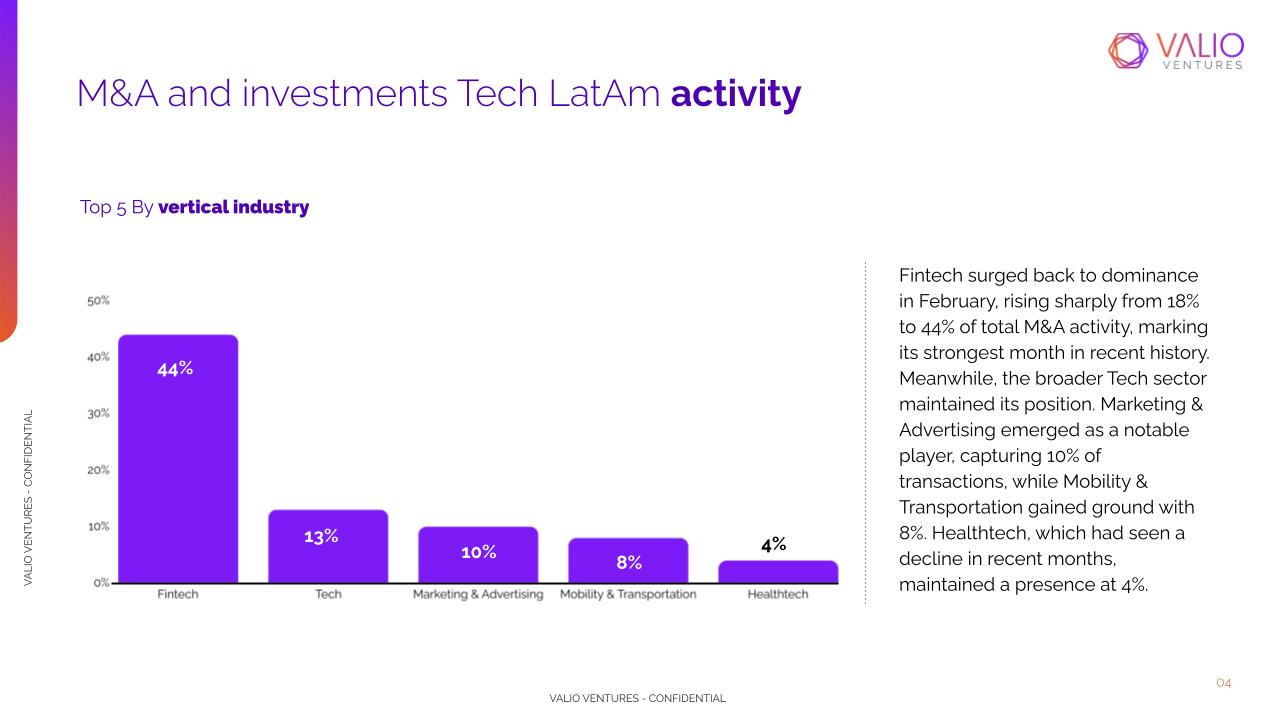

Trends by Vertical Industry

The fintech sector surged in February, representing 44% of all tech M&A activity, up significantly from 18% in January, marking its strongest month in recent history. The broader tech sector maintained its position, with Marketing & Advertising and Mobility & Transportation also emerging as key players, representing 10% and 8% of the total transactions, respectively. Healthtech, while maintaining a presence at 4%, saw a decline in activity compared to previous months.

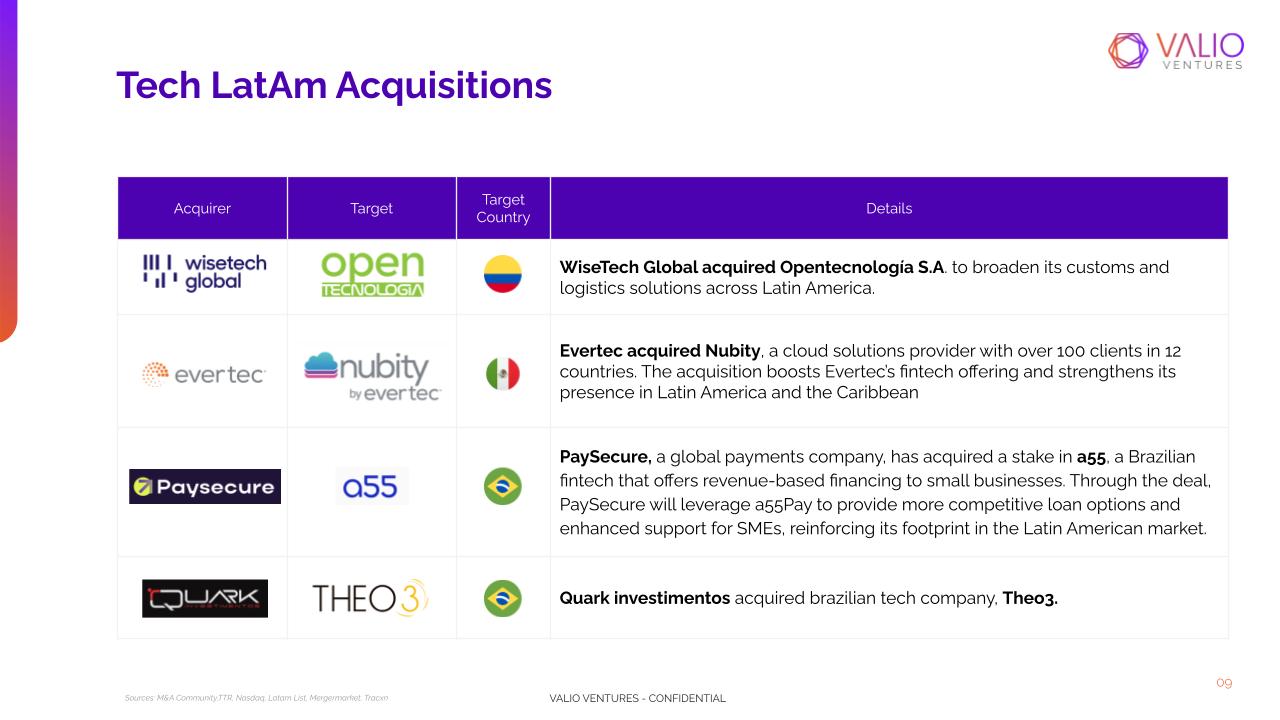

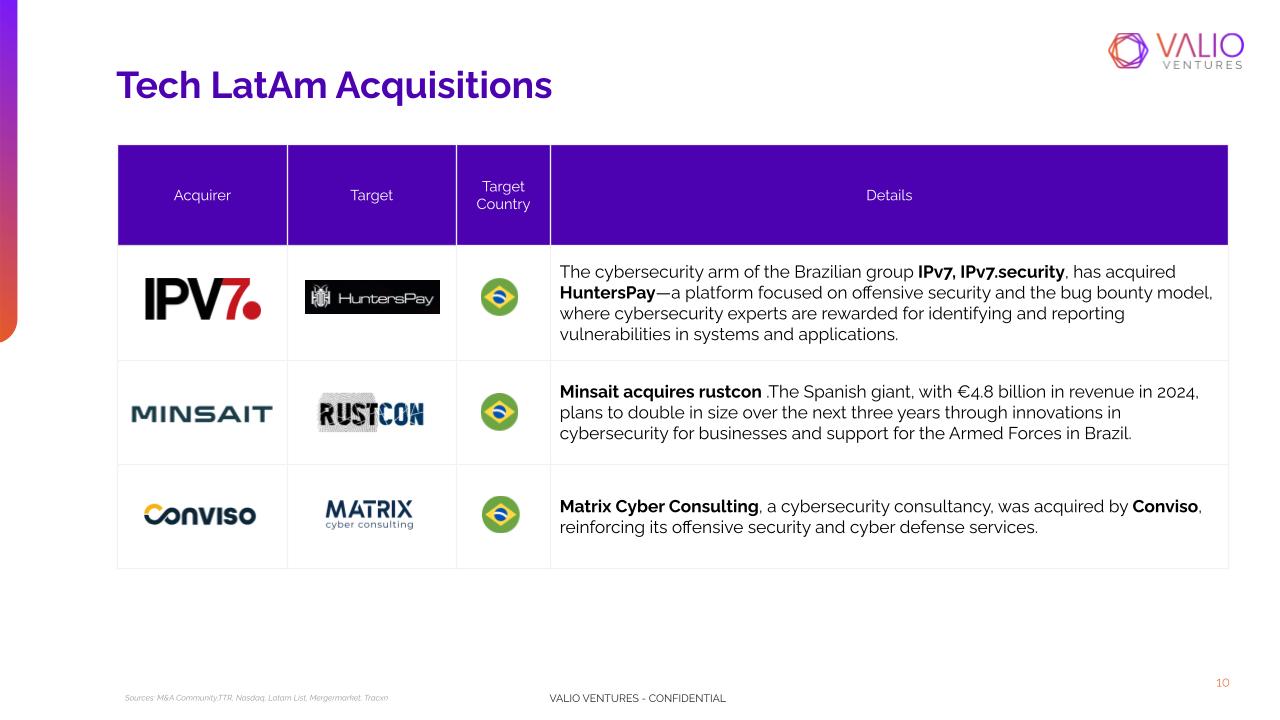

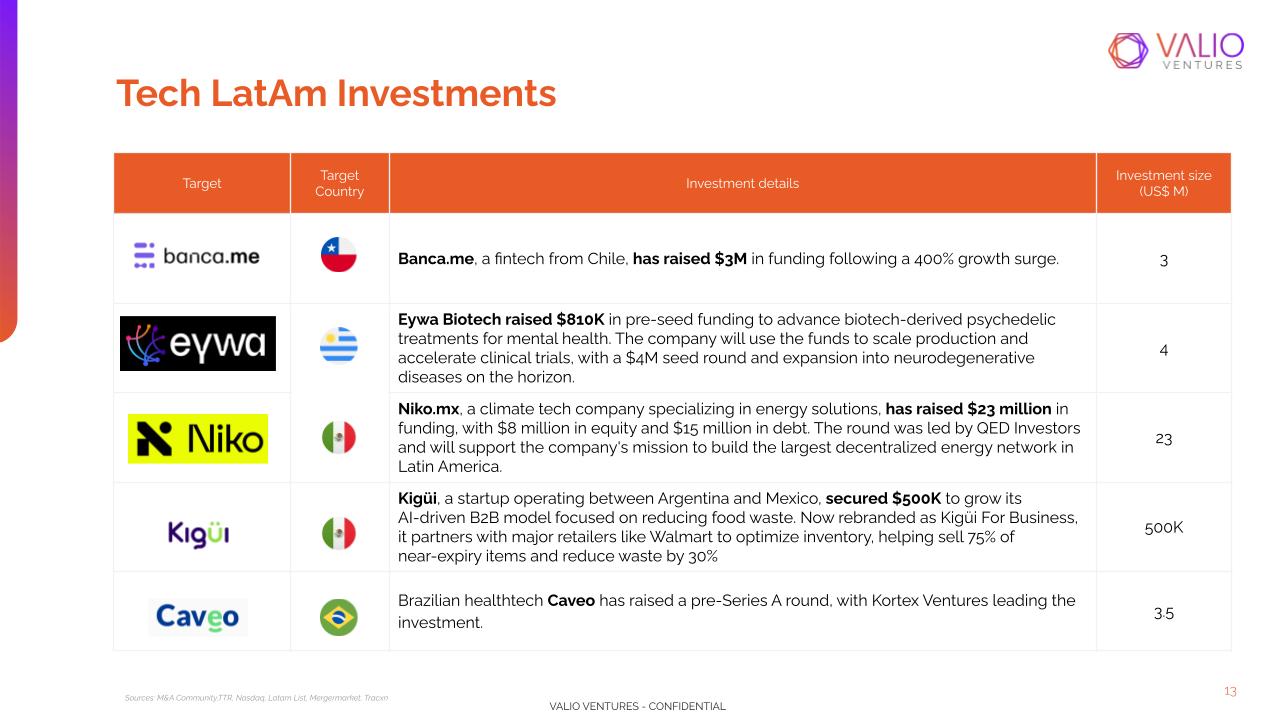

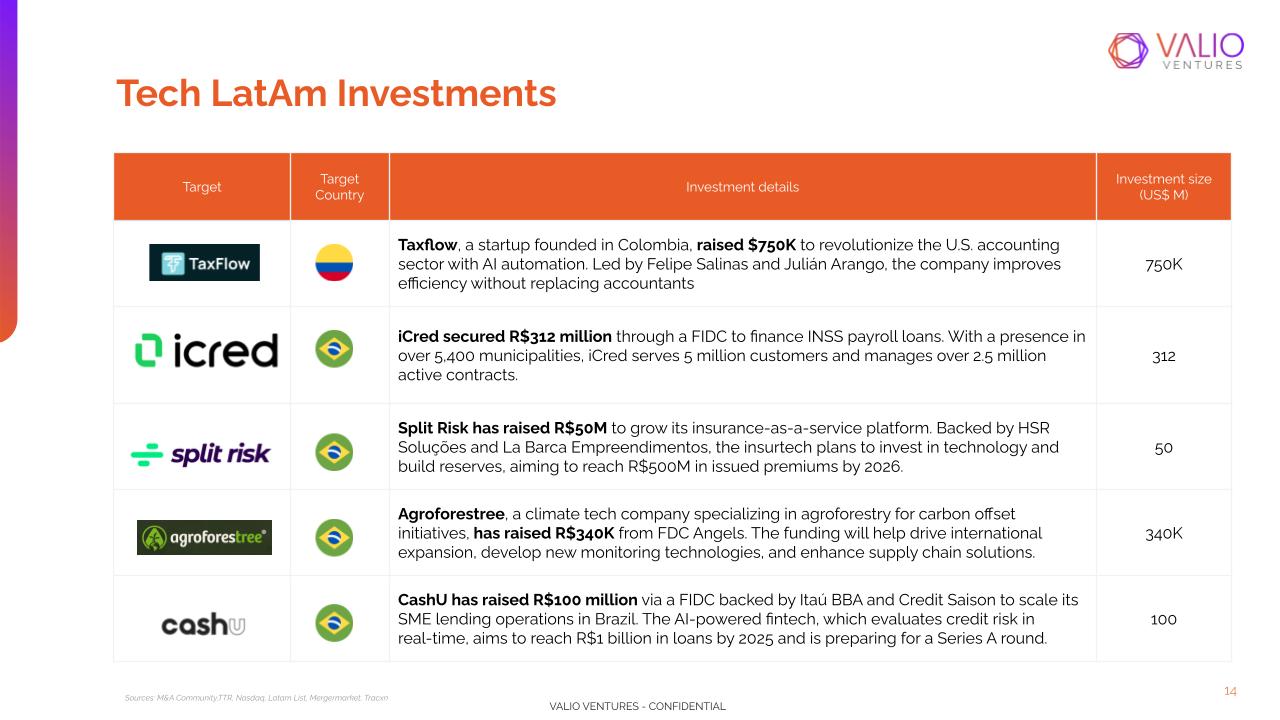

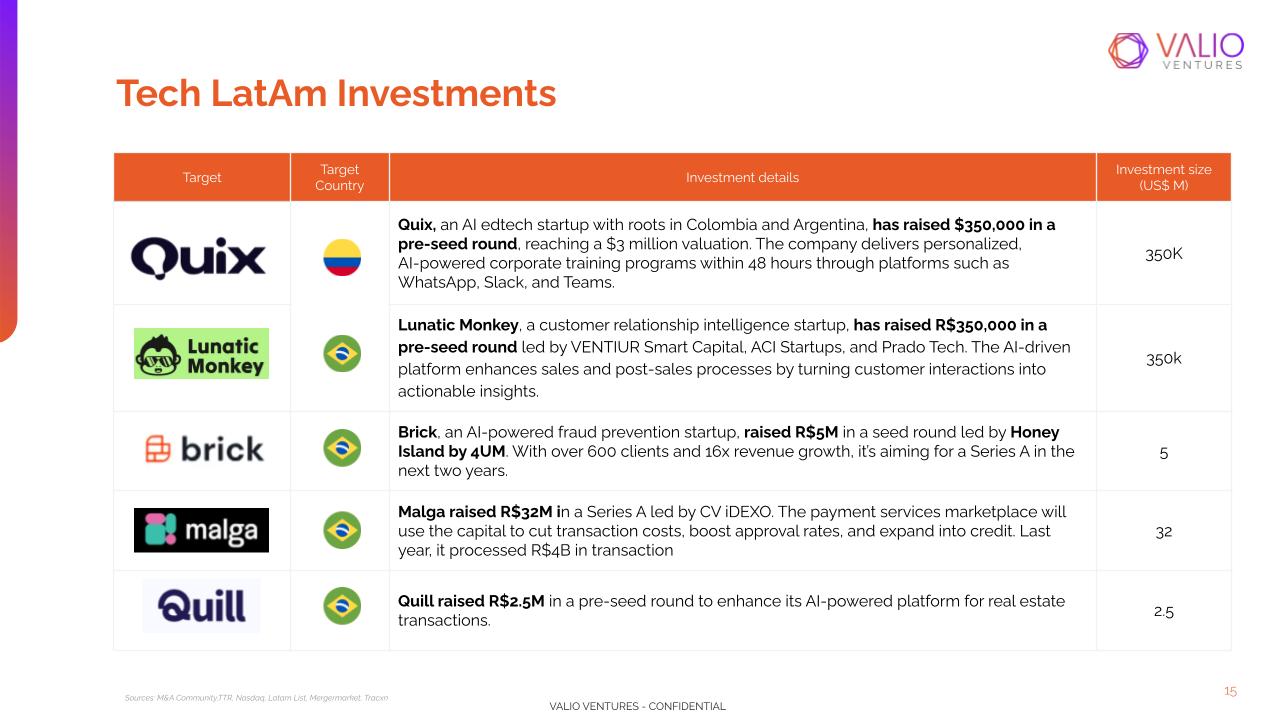

Deals and Investments:

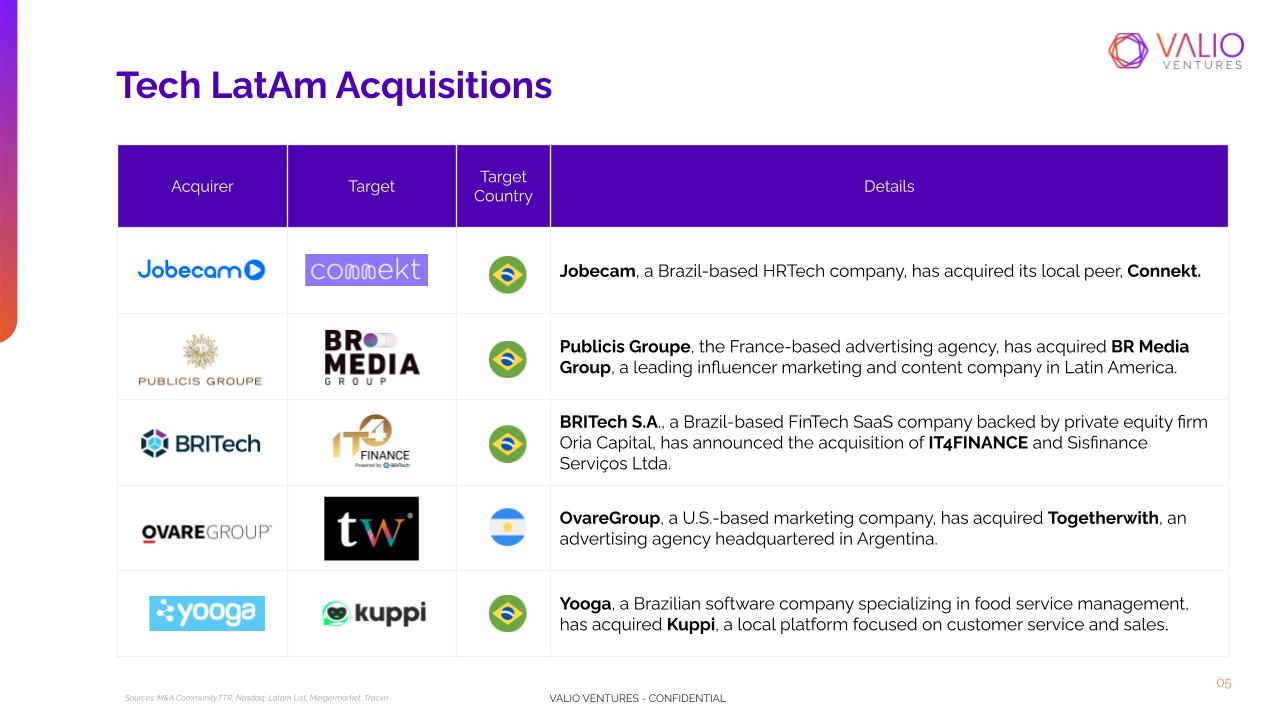

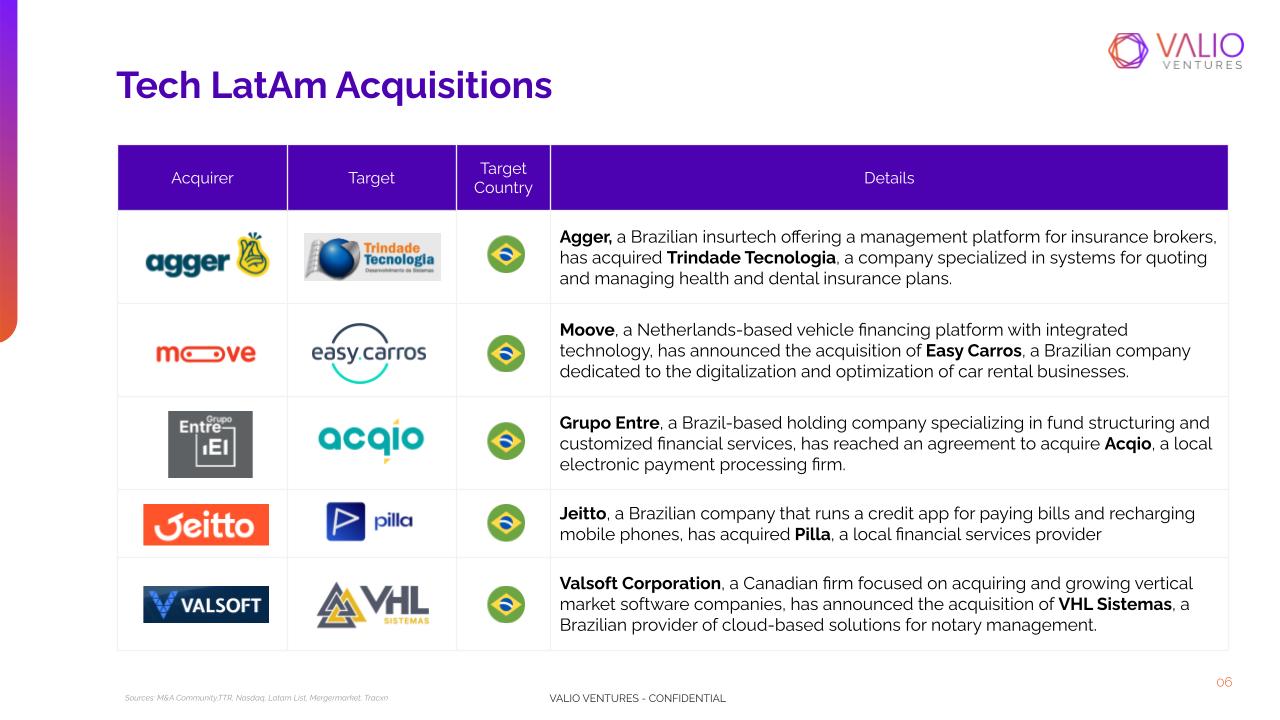

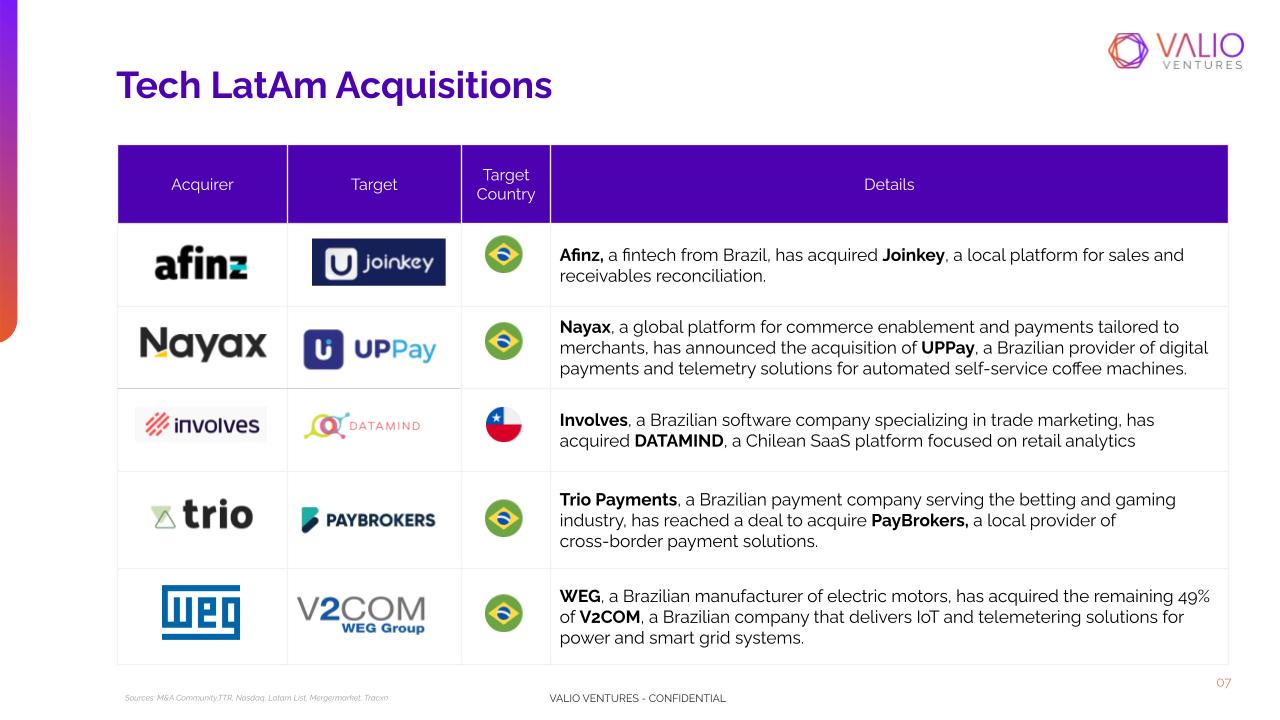

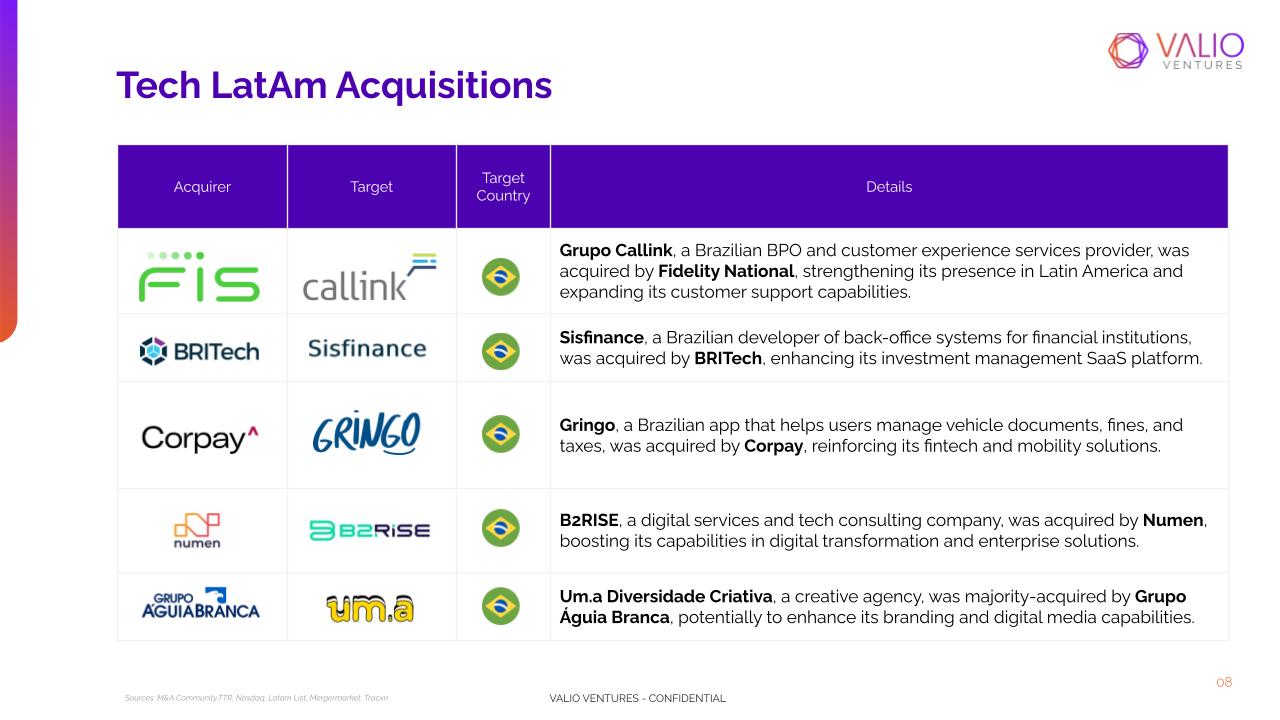

The monthly report includes a detailed list of significant deals and investments that occurred within the month. Some notable transactions include acquisitions across a wide range of tech verticals, such as HRTech, fintech, and insurtech, further illustrating the region’s dynamic M&A landscape.

Top 5 Deals:

- Jobecam (Brazil) acquired Connekt (Brazil) – An HRTech company expanding its capabilities in workforce management.

- Publicis Groupe (France) acquired BR Media Group (Mexico) – A leading influencer marketing and content company in Latin America.

- BRITech (Brazil) acquired IT4FINANCE and Sisfinance Serviços Ltda (Brazil) – A fintech SaaS firm strengthening its position in the financial services sector.

- OvareGroup (USA) acquired Togetherwith (Argentina) – An advertising agency expanding its presence in Latin America’s marketing sector.

- Valsoft Corporation (Canada) acquired VHL Sistemas (Brazil) – A provider of cloud-based solutions for notary management, enhancing Valsoft’s software portfolio.

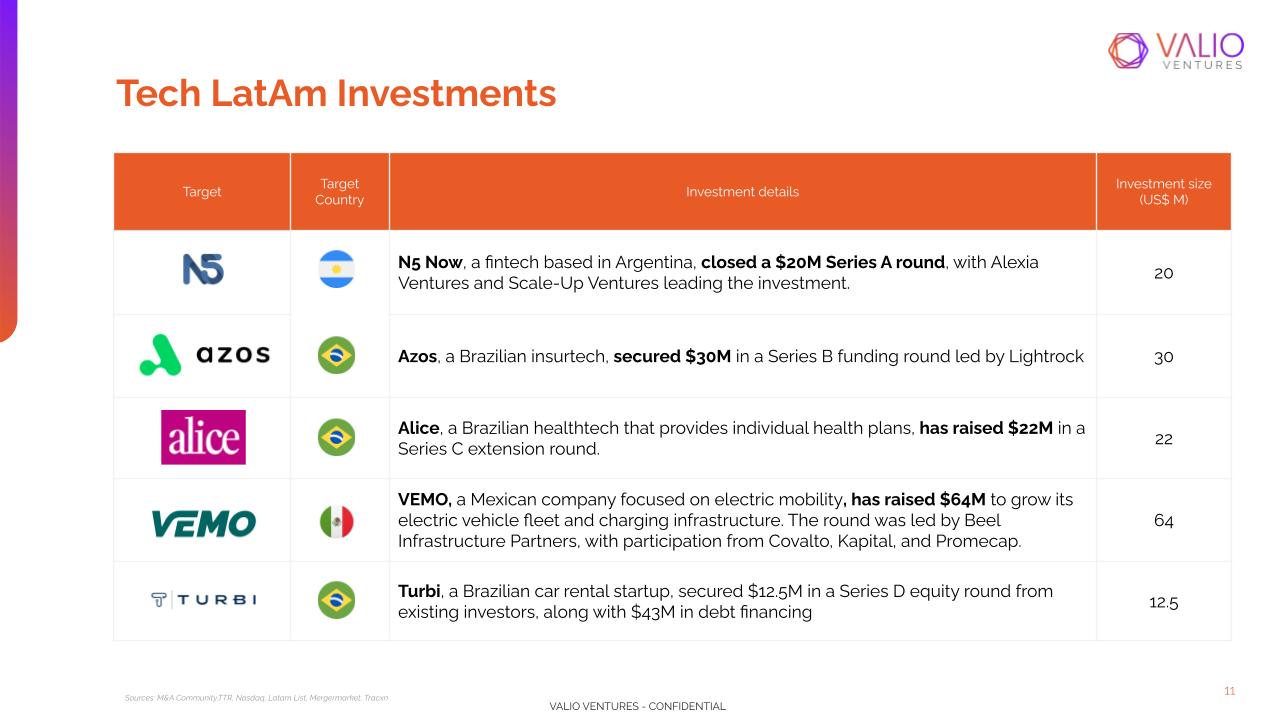

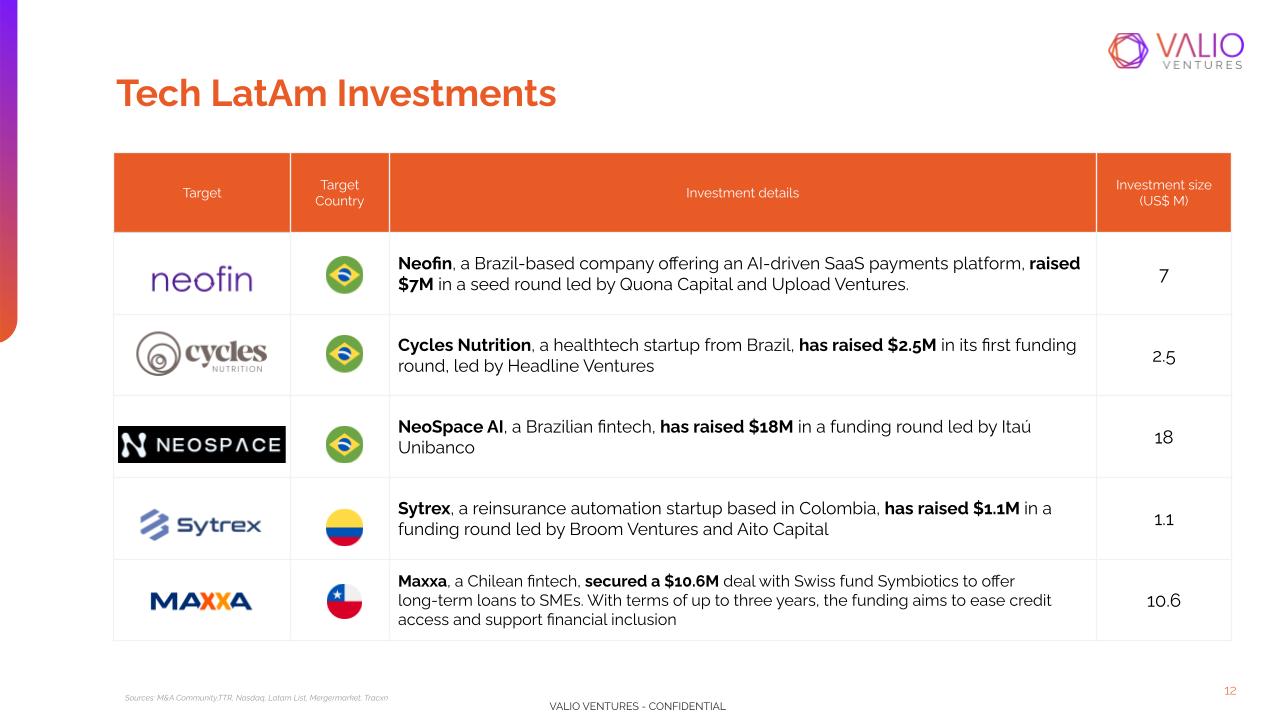

Top 5 Investments:

- N5 Now (Argentina) raised $20M in a Series A round, led by Alexia Ventures and Scale-Up Ventures, to further expand its fintech platform.

- Azos (Brazil) secured $30M in a Series B funding round led by Lightrock, focusing on its insurtech solutions.

- VEMO (Mexico) raised $64M to expand its electric vehicle fleet and charging infrastructure, led by Beel Infrastructure Partners.

- Neofin (Brazil) raised $7M in a seed round led by Quona Capital and Upload Ventures, enhancing its AI-driven payments platform.

- Sytrex (Colombia) raised $1.1M to expand its reinsurance automation services, supported by Broom Ventures and Aito Capital.

These transactions highlight the region’s growing interest in fintech, insurtech, and other technology-driven sectors. While Brazil remains a key player, countries like Mexico, Argentina, and Colombia are gaining significant attention, reflecting the regional diversification in both M&A deals and investments.

Wrapping Up: The Resilience of Tech M&A in LatAm Amid Market Challenges

The M&A market in Latin America presents a mixed yet interesting picture. While the overall M&A activity has slowed down, the tech sector continues to show robust growth, underlining the region’s strategic importance for technology-focused investors and acquirers. Argentina’s exceptional performance highlights the potential of the market in select countries, while Brazil continues to be the dominant player in the region’s M&A space. As we move into 2025, the continued interest in Latin America’s tech market, especially fintech, offers promising opportunities for both local and international stakeholders.

Suscribite a nuestra Newsletter

Recibe en tu inbox todos los meses las novedades más importantes de M&A en tecnología en LatAm